The Energy Tax Aspects of Revitalizing Detroit's Building Engine

Detroit has some of the nation’s most impressive commercial building inventory. As a result of the economic downturn, the market values of those properties have declined to bargain prices that are getting leading property investors’ attention. Many of these buildings require renovations eligible for large EPAct tax incentives.

EPAct Tax Opportunities

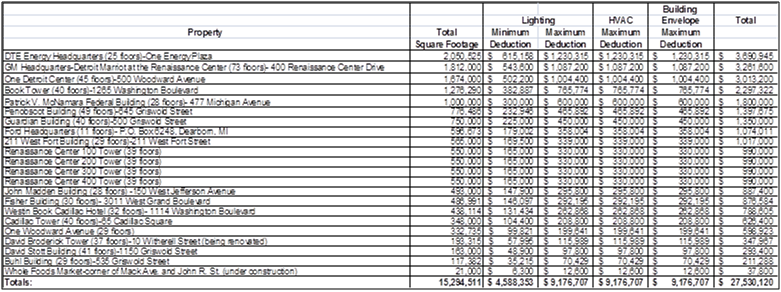

Pursuant to Energy Policy Act (EPAct) Section 179D, buildings making qualifying energy-reducing investments in their new or existing locations can obtain immediate tax deductions of up to $1.80 per square foot.If the building project doesn't qualify for the maximum $1.80 per square foot immediate tax deduction, there are tax deductions of up to $0.60 per square foot for each of the three major building subsystems: lighting, HVAC (heating, ventilating, and air conditioning), and the building envelope. The building envelope is every item on the building’s exterior perimeter that touches the outside world including roof, walls, insulation, doors, windows and foundation.

Recent Transaction

The economic downturn has hurt the property value of iconic Detroit buildings. For example, the Penobscot Building was sold to the Canadian real-estate company Triple Group for $5 million. The $5 per square foot price was a bargain compared to $28 per square foot at which buildings in downtown Detroit were valued in 2011, and vastly cheaper than the $200 per square foot average price tag for buildings nationwide, according to Real Capital Analytics.Detroit's Population Trend

One of the factors contributing to Detroit's falling real estate values is the city's declining population. According to data from the United States Census, Detroit's population has declined from 945,297 in July 2000 to 713,777 in July 2010. The most pronounced drop occurred between July 2009 and July 2010, when 85% of the aforementioned population decline occurred.Discerning Tenants

As energy costs rise and lease prices fall, the relative cost of energy becomes increasingly discernible. The DOE estimates that the average energy cost for an office building is $1.51 per square foot . In New York City, where rent per square foot is $48 , energy is approximately 3% of lease costs. By contrast, Triple Properties plans to rent space in the Penobscot building at a price of $10 ; at that price, energy costs amount to 15% of a lease. With energy constituting a much greater portion of the costs to rent a Detroit office space, and with energy benchmarking becoming increasingly standardized (if not required), Detroit office managers have a need to assist owners in making their properties more attractive to tenants through energy-efficient improvements.Sample Detroit EPAct Tax Opportunities

The table below presents the EPAct potential benefits for the Penobscot Building. Additionally, the EPAct opportunity for some of Detroit's other larger buildings are presented, including the downtown Westin hotel, a marquee property already restored, and the new Whole Foods currently under construction.

Conclusion

Population decline has been a major factor in the decline of Detroit real-estate values. By making improvements to lighting, HVAC, and building envelope, building owners can improve the energy efficiency of their buildings as well as save taxes. Reduced energy costs, in turn, should help lure more tenants back to Detroit properties as the city continues its efforts at overhaul and revitalization.