EPAct 179D Tax Savings for Supermarkets

Energy costs are very high for supermarkets (compared with other boxed structures, measured on a cubic footage basis) because supermarkets

•have all the normal building energy operating costs,

•typically operate seven days a week for long hours, and

•have the added energy cost of refrigeration for coolers and freezers.

Supermarkets can benefit from a variety of today's energy saving products, coupled with state rebates and utility rebates, along with federal tax incentives to greatly reduce their operating costs. Tax advisers for supermarkets can work closely as a team with operating management, facilities managers, and energy departments to achieve these operating cost reductions.

Lighting

Supermarkets incur high lighting electricity costs both for basic store use and for presenting food products. Supermarkets can upgrade existing center store-basic vertical aisle lighting to create energy efficient lighting eligible for large tax savings. Supermarkets can obtain additional energy savings by installing rooftop skylights over store aisles, since daylight hours are always part of the stores’ operating day. A supermarket can use skylights and daylighting sensors to dim or to shut off electrical lighting based on the level of daylight illuminating the aisles.

Outside the core center store selling area, supermarkets actually become very complicated spaces since each of the specialized departments such as produce, deli, meat, bakery, and dairy all have specialized lighting needs. A standard supermarket has a back of the house (behind the main selling floor) used for delivery, storage, and administrative offices. Supermarkets can typically use very energy efficient standard lighting products to upgrade these rooms.

Supermarkets can utilize two alternative methods for achieving Energy Policy Act (EPAct) Section 179(D) lighting tax deductions of up to 60 cents per square foot.

1. Using the prescriptive method, the supermarket needs to reduce the lighting watts per square foot in each space (room with four floor-to-ceiling walls) by at least 25% as compared to the ASHRAE 2001 building energy code to begin getting tax deduction at the 30 cent per square foot level. Full tax deduction of 60 cents per square foot occurs at 40% wattage reduction, which supermarkets generally achieve if they upgrade the entire selling floor lighting with a focus on the required Section 179(D) targets wattage targets.

2. Alternatively, supermarkets can use the IRS approved energy modeling method for lighting. This modeling method produces more favorable results for supermarkets with day lighting systems, skylights, lighting control systems and building management systems with a lighting controls component. The supermarket must use an IRS approved energy modeling software to obtain the tax deduction. Supermarkets which combine very efficient lighting with skylights will often qualify for a $1.20 combined lighting and building envelope tax deduction, since the 179(D) building envelope deduction only requires a 10% energy cost reduction compared to ASHRAE 2001.

Refrigeration

A supermarket can minimize the substantial refrigeration energy costs related to coolers and freezers. These coolers and freezers are commonly called cases. Modern freezers and coolers use substantially less energy than prior generation equipment because of greatly improved compressor technology and other improvements, particularly with centralized store systems. Most importantly, the lighting in today’s refrigeration cases are much more energy efficient since converting from heat based lighting to cool environment lighting such as fiber optics and LED's (Light Emitting Diodes). Before the advent of this cool temperature lighting, supermarkets had to expend additional energy costs for cooling merely to overcome the heat generated by the case lighting before even beginning to perform their core cooling function.

Tax professionals who are interested in these energy efficient refrigeration opportunities should study the websites of the two major equipment suppliers which are:

1. The Hill Phoenix subsidiary of Dover Corporation (www.hillphoenix.com), and

2. The Hussmann subsidiary of Ingersoll Rand (www.hussmann.com)

Heating, Ventilation and Air Conditioning (HVAC)

Supermarket tax departments should give strong consideration to having their most energy efficient stores modeled in IRS approved software. Section 179(D) EPAct deductions for HVAC and the building envelope must be supported by an IRS approved model. Many state and utility programs will provide for some or all of the energy modeling costs when a supermarket is contemplating an HVAC or other major energy reducing system upgrade. Once a supermarket chain has their most energy efficient prototype modeled they can use that result as a beta to plan into $1.80 per square foot EPAct tax deductions for all stores.

There are a variety of supermarket HVAC techniques that can materially reduce energy costs including heat recovery ventilation, energy recovery ventilation, and demand control ventilation.

It is particularly important for supermarkets to manage humidity control since humidity can cause refrigeration systems to develop condensation on display doors and frost buildup. Economizer units can be added to provide free cooling during spring and fall or on cool summer nights when the humidity level is not too high. Because supermarkets have so many different energy consuming systems, it is crucial to have a centralized energy management system.

Large Non-Store Spaces Present Greater Tax Opportunities

Many super market chains have additional large non-retail store buildings, including non-conditioned (no HVAC) and conditioned warehouses and often food processing centers. Warehouses are the only section 179(D) lighting category where tax deduction is “all or nothing,” meaning that the facility either needs to qualify for the 60 cent lighting tax deduction or there is no EPAct tax deduction. Supermarkets contemplating warehouse lighting upgrades should consult with tax advisers familiar with warehouse lighting tax planning, including issues involving mezzanine floors, pick and pack modules and non warehouse sub spaces. Food processing centers with energy efficient lighting generally qualify for very large EPAct lighting tax deductions.

LEED Supermarket Facilities

LEED stands for Leadership in Environmental and Energy Design and is the marquee standard for a sustainable building. There are four levels of LEED accomplishment with Platinum being the highest level followed by Gold, Silver, and LEED certified. The LEED system is administered by the United States Green Building Council (USGBC). Recently, the first platinum-certified LEED supermarket in the United States was awarded to the Hannaford supermarket chain in Augusta, Maine. This state-of-the-art facility, which uses 50% less energy than a typical supermarket and almost 40% less water, also functions as a laboratory for Hannaford that will continue to experiment with new energy-reducing innovations on behalf of their entire store chain. The LEED system provides LEED award points for water reduction, but water reduction is not eligible for EPAct tax deductions.

For tax purposes, a major advantage of LEED supermarkets is that they already have a required LEED building energy simulation model that can be converted to an IRS compliant EPAct model, which will support tax deductions. Presuming that when modeled for EPAct, the Hannaford supermarket has also achieved a 50% energy cost reduction compared to ASHRAE 2001, it may potentially qualify for the full $1.80 per square foot Section 179(D) EPAct tax deduction. As it stands, this LEED certified grocery store, the first of its breed to attain the platinum designation, features a 7,000 square foot green roof, geothermal heating and cooling, and interior daylight harvesting capabilities, among numerous other technologies.1

Recently, the Price Chopper supermarkets opened one of the nation’s most environmentally friendly food stores in Colonie, NY. Some of the energy efficient measures used in the store are the use of natural lighting, recycling more than 75% of construction waste, and using state of the art refrigeration equipment. The 69,000 square foot facility also uses fuel cell technology to generate the power needs of the store.2

The first supermarket to achieve LEED status was the Giant Eagle supermarket in Ohio in 2004. Since that inception, Giant Eagle had also unveiled the first LEED-silver and gold certified stores in April 2007 and October 2008, respectively.3

Combined Measure State and Utility Rebate Planning

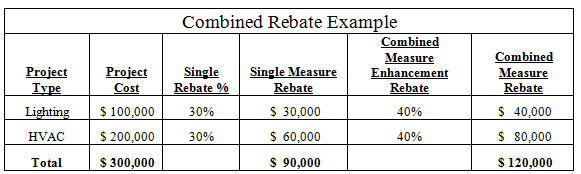

It is particularly important for supermarkets to consider seeking combined measure utility rebates. Many utilities will provide an enhanced rebate for what are called multiple energy reduction measures. For example, let’s presume that for qualifying energy efficient equipment, a standard lighting rebate from a particular utility is 30% of purchase price and likewise 30% for energy efficient HVAC. The utility might offer an enhanced rebate of an additional 10%. In this example, each rebate will increase by 10% to 40% for each measure. The following table illustrates how combined measure rebates work, using an example project where new lighting costs $100,000 and new HVAC costs $200,000.

In the above example, because the building owner applied for a combined measure rebate, the utility rebate was increased by $30,000 (from $90,000 to $120,000).

Because supermarkets require so many different kinds of energy related equipment it is crucial for supermarkets to use utility rebate planning coupled with tax planning to enhance energy reducing investments economic payback outlays and minimize energy related operating costs.

Conclusion

Since supermarkets are the highest energy cost commercial building category, store energy, construction and facility managers have tremendous energy cost savings opportunities. The nation’s first LEED platinum supermarket can serve not only as laboratory for its own supermarket chain but for the rest of the supermarket industry. Tax professionals that understand utility rebate planning and energy tax incentives can help support the desired energy reduction investment.

References

1. Robbins, Frank. “Maine Supermarket Gets LEED Platinum.” Jetsongreen.com. August 4, 2009. Available at http://www.jetsongreen.com/2009/08/maine-hannaford-supermarket-gets-leed-platinum.html

2. Air Conditioning, Heating, & Refrigeration News. “New LEED Store Will Be First LEED Certified Supermarket in NY.” Air Conditioning, Heating, & Refrigeration News. January 19, 2009. Available at

http://www.achrnews.com/Articles/Manufacturer_Reports/BNP_GUID_9-5-2006_A_10000000000000508114

3. Smart Brief Newswire. “Giant Eagle Columbus Supermarket Becomes LEED Gold(R)- Certified. Smart Brief. September 29, 2008. Available at

http://www.smartbrief.com/news/aaaa/industryPR-detail.jsp?id=7F1A7E49-42FE-496E-B550-2A4A36EFB2F1