Legal and Technology Changes Enable Large Tax Deductions for Apartment Buildings

In exciting recent developments new and existing apartment buildings are now able to achieve major energy cost reduction supported by the potential for large first year tax deductions.

The Section 179(D) Tax Provisions

Pursuant to Section 179 D of the Energy Policy Act (EPAct) and its underlying ASHRAE (American Society of Heating Refrigeration and Air Conditioning) building energy code rule set an apartment building four stories or above is considered a commercial building eligible for energy efficiency tax deductions of up to $1.80 per square foot. If a buildings energy reducing investment doesn't qualify for the full $1.80 per square foot deduction any of the three major sub system including 1. Lighting 2. HVAC (Heating, Ventilation and Air Conditioning) and 3. the building envelope can qualify for up to 60 cent per square foot EPAct tax deductions each. The building envelope is anything on the perimeter of the building that touches the outside world including roof, walls, windows, doors the foundation and related insulation layers.

Importance for Cities

Most four story or above apartment buildings are found in major cities where electricity is supply constrained and expensive. The previous cost effective technology barriers to apartment building large energy scale cost reduction are quickly disappearing. Landlords who may have previously concluded that there was no incentive for themselves to make tenant energy cost savings investments may now conclude that the combination of integrated energy savings, utility rebates, EPAct tax savings and demand response payments actually produces economic benefit for the landlord.

Lighting Legal Changes: The Lighting Section 179(D) Tax Deduction

To be eligible for the lighting EPAct tax deduction using the wattage reduction method the wattage in each room must be reduced by at least 25% from the ASHRAE 2001 building code standard. Typical apartment spaces (rooms) include the primary apartment spaces, corridors, stairways, mechanical rooms, storage, recreation and social area's, laundry rooms, offices and may include parking garages. The previous technology barrier to tax deduction was that the lighting in most of the main apartment spaces has been incandescent lighting that used far more wattage than the reduced levels required for tax deduction.

Lighting Technology Changes

There are now three incandescent lighting technology replacements that comply with the legal mandate and typically will meet the requirements for the apartment building tax deduction. Those technologies include 1. compact fluorescents (CFL's), 2. new Light Emitting Diode's (LED) products in bulb form and 3. recently developed low wattage incandescents.

Lighting Legal Changes

Most of the typical incandescent bulbs used in apartment rooms are being phased out by Federal legal mandate prohibiting further manufacturing or importation into the United States beginning in 2012.1 Effective July 1, 2010 T-12 fluorescent lighting often found in apartment building support area's such as parking garages, laundries, storage and mechanical areas may no longer be manufactured or imported into the United States. 2

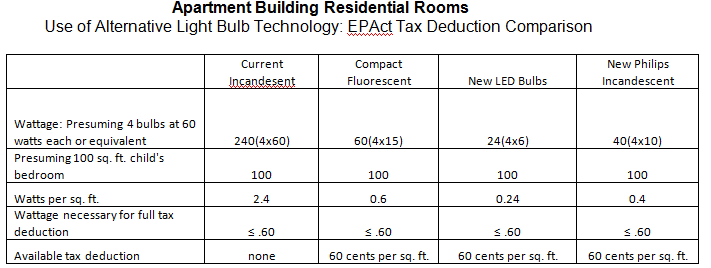

Most Americans are familiar with CFL's where some of the concerns have been with mercury content, basic design appearance and dimming capability. The new bulb like LED's meet many of these concerns since they are mercury free, look like traditional bulbs and can be dimmed. To understand the previous wattage reduction challenge and the opportunities with the new products the following table should be of assistance.

All of the major light bulb manufacturers have CFL product offerings. The big three for the new LED bulbs are Lemmis Lighting, Tendris, and Lighting Sciences Group. Lendris offers a three year warranty and estimates that when using a national average utility rate of 15 cents per kilowatt their product has a 3 year economic payback. 3

HVAC Technology Improvements

Previous generation technologies and construction processes made it very difficult for apartment buildings to qualify for any of the EPAct tax deduction opportunities. Now as result of major technology developments with apartment HVAC subsystems, large tax deductions are becoming very achievable.

Most residential apartment buildings utilize though the wall individual apartment HVAC units units to provide heating and cooling. These units are known as Packaged Terminal Air Conditioners or PTAC units. Historically these residential PTAC units were only a few more percentage points more energy efficient as compared to the ASHRAE 2001 building energy code standard, where a 16.67% is required for the HVAC EPAct tax deduction. The major technology improvements are a combination of improved core unit energy efficiency along with custom designed HVAC controls, primarily load shedding controls. New generations of PTAC units are materially more energy efficient than prior generations of PTAC units. The energy efficiency of a PTAC is expressed commercially as its SEER level meaning Seasonal Energy Efficiency Rating. Select manufacturers have some very high efficiency units that will clearly be eligible for the 60 cent per square foot tax HVAC EPAct tax deduction. In a July 2008 article, the title itself which is " Innovative PTAC Solution Provides 50 Percent Energy Savings" conveys the magnitude of savings available with a PTAC combined equipment upgrade and controls solution.4

The Chiller EPAct Tax Advantage

Some apartment buildings, particularly high end residential buildings, use very energy efficient large central chillers to provide HVAC. These systems will normally support large HVAC EPAct tax deductions since the HVAC EPAct calculation is based on a comparison of the energy costs of the very efficient chiller against historically lower ASHRAE 2001 PTAC units. For tax planning purposes it is important for apartment building owners considering a chiller replacement to complete that installation before January 1, 2014 while the lower ASHRAE 2001 PTAC efficiency standards are still in effect.

Combining Lighting and PTAC Investments

Existing apartments that combine both the lighting HVAC ,PTAC, and chiller solutions described above before January 1st, 2014 will achieve substantial energy cost reduction and have the potential to achieve $1.20/sq.ft. to $1.80/sq.ft. EPAct tax deductions.

Moreover many utilities will offer an enhanced utility rebate if both of these investments are combined in one project.

Building Envelope

Since the building envelope itself doesn't use energy the EPAct tax deduction requires the envelope itself to reduce the energy used by the existing lighting and HVAC systems, described above, in order to obtain EPAct tax deduction. With new apartment buildings one of the major construction changes now occurring is the use of pre fabricated building envelope items that are extremely well insulated. New apartment buildings also have the opportunity to install very energy efficient windows on a more cost effective basis. New apartment buildings with this construction approach that combine the lighting and HVAC solutions described above will potentially qualify for the $1.80 per square foot tax deduction. Existing buildings can use investments in new roofs, windows, window treatments and added insulation along with the lighting PTAC combination to qualify for large EPAct tax deductions.

Building Computer Simulation Modeling Requirement

To individually qualify the HVAC, and Building Envelope subsystems for the $1.80 whole building EPAct deduction, the building performance must be modeled. Lighting can also qualify for the deduction via modeling. These same energy models are also required for LEED building projects. [LEED stands for Leadership in Energy and Environmental Design, and is the marquee sustainable building certification program operated by the U.S. Green Building Council(USGBC). ]When using modeling the required level of energy reduction must be documented with an IRS approved building energy model.

Landlord Sharing Arrangements

A landlord building owner isn't going to qualify for the apartment commercial lighting tax deduction of 60 cents per square foot unless the landlord makes the lighting investment. For example for each 100,000 square foot of apartment space renovated to LED lighting the landlord will obtain a $60,000 tax deduction and the tenants will experience up to a 90% lighting energy cost reduction. Since the LED bulb replacements are expensive and both parties are obtaining large economic benefits they may want to work out a cost sharing agreement. Note that the overall investment may qualify for a large utility rebate. A large lighting wattage reduction will make it easier for the landlord to qualify for the HVAC EPAct tax deduction any time the combined investments result in a 33.34% overall building energy cost reduction. Simply stated the landlord needs to work with the tenant to obtain the energy cost reduction necessary to qualify for the EPAct lighting tax deduction in order to optimize the potential for an HVAC EPAct tax deduction.

Conclusion

The apartment market has been waiting for a long time for major justified energy cost reduction where both landlords and tenants can share the benefits. The time is now here and landlords and tenants need to work together to integrate the tax and other economic opportunities to make it happen.

References

1.Ballast Energy Efficiency Standards(BEF) included in the Energy Policy Act of 2005

2.See Section 321 entitled General Service Incandescent lamps of the Energy Independence Act Second act of 2007.

4." Innovative PTAC Solution Provides 50 Percent Energy Savings.” Manufacturer Reports Air Conditioning, Heating & Refrigeration News. July 07, 2008