EPAct 179D Tax Savings for Car Dealerships

The well publicized metamorphosis of the U.S. automobile industry is having a major impact on car dealership facilities. Numerous dealerships are closing as the result of entire brand terminations and the severe downturn in the economy. However, the surviving dealers are consolidating their facilities and focusing on operating cost reduction. Consistent with a focus on fuel efficient cars, many dealers are focusing on energy efficient facilities.

The Tax Opportunity

Pursuant to Section 179(d) of the Energy Policy Act (EPAct), dealers can obtain large tax savings by upgrading their existing facilities or building new dealerships to EPAct standards anytime between January 1, 2006 and December 31st, 2013.1 At the whole building level, immediate tax deductions of $1.80 per square foot are available for achieving a 50% energy cost savings as compared to a 2001 AHSRAE building energy code standard. For the buildings that do not qualify for the $1.80 tax deduction, incentives are available at the subsystem level for each of the 3 major building subsystems. Tax deductions for qualifying energy efficient lighting are available at 30 to 60 cents per square foot and for HVAC (Heating Ventilation and Air Conditioning) and the building envelope at 60 cents per square foot each.

Understanding Dealer Facilities

Dealerships typically have a standard combination of spaces with entirely different energy attributes, including showrooms, repair shops, parts and warehouses, lounge areas, and open and closed offices. Dealerships can obtain energy and tax savings by employing different technologies relevant to the specific needs of the different spaces.

Car Showrooms

Showrooms are typically wide open spaces with floor to ceiling windows. The large amount of window spaces enable dealers to use daylighting sensors and daylight shading systems that can save substantial lighting energy costs by utilizing natural light to reduce or even shut off the lights during the sunny part of the day. With show room lighting, the car is the star and lighting designers normally seek to balance product presentation and color rendition with energy savings. Showrooms need to maintain pleasant, consistent temperatures to assure customer comfort, and highly energy efficient HVAC systems can save substantial operating costs.

Repair Shops

It is crucial for repair shops to have HVAC systems that regularly exchange clean outside air with existing air to control carbon dioxide levels. These Energy Recovery Ventilation Systems(ERV’s) can be designed so that the temperature of the outgoing building air can be transferred (heat exchanged) with the new air, greatly reducing the cost of heating or cooling the new air to the desired temperature. For example, in the winter, the goal is reduce the cost of heating the outside cold air and in the summer you don't want to bring the outside hot air into the building. ERV systems often qualify for the EPAct HVAC 60 cent tax deduction. Existing repair shops often have energy inefficient T-12 fluorescent or metal halide lighting, where a lighting retrofit may reduce the lighting electrical bill by 40 to 60 percent. This inefficient lighting is subject to new Federal and State rules prohibiting further manufacturing, which means the price or replacement bulbs will steadily increase. The energy efficient replacement lighting typically qualifies for the EPAct lighting 60 cent tax deduction.

Parts Storage/Warehouse

Theses spaces also often have the same prior generation T-12 fluorescent or metal halide lighting where tremendous energy cost reduction is available. These spaces can also save large energy costs by using sensors to shut lights off during non-use periods. Again, the replacement lighting will typically qualify for the EPAct lighting 60 cent tax deduction.

Offices and Lounges

Some dealer offices, particularly sales offices, are open and integrated into the showroom floor, and other offices are closed offices. Stand-alone enclosed offices should utilize lighting controls to turn lights off in unoccupied offices and utilize daylight controls in perimeter offices with outside windows.

Customer lounges vary in size and services offered and may be interconnected to the showroom. Interior designers need to balance ambiance and energy efficiency, and all appliances and computer work stations should be as energy efficient as possible.

In the office environment, the lighting designer is going to have to make an extra design effort if the goal is to minimize energy use and obtain the EPAct lighting tax deduction. At the very least, the lighting 30 cent minimum tax deduction should be achievable.

LEED Dealerships

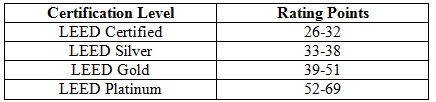

Some of the manufacturer (company owned) owned dealers and many individual dealers are striving to achieve LEED certification for their facilities. LEED stands for Leadership in Energy and Environmental Design, and is the marquee standard for a sustainable building. LEED uses a rating point system with four levels of achievement as follows:

Achieving a sustainable and energy efficient dealership facility is consistent with the concept of offering sustainable and fuel efficient cars. A LEED building requires building an energy computer simulation model, which is also the perquisite for obtaining an EPAct, HVAC or building envelope tax deduction. Dealers that incorporate the energy efficient lighting and heat exchange HVAC concepts discussed above have the potential to obtain an immediate $1.80 per square foot Section 179(d) EPAct tax deduction.

Some examples of recently announced LEED car dealerships include Mercedes-Benz in Peoria, Illinois, Toyota in Rockwell, Texas and Lexus in St. Louis. The Mercedes-Benz dealership’s accomplishments include many features described above and are as follows:2

Six gallons of water used per car wash per vehicle (compared to a typical of 20).

Roof-mounted P.V. solar panel array – during off-peak hours, up to 35% of the building’s power will be generated.

Improvement of energy efficiency due to an insulated fascia system wrapped around the structure.

Increased conservation and use of recycled water for landscape irrigation with high-efficiency mechanical reclamation systems.

Ceiling tiles will be made of recycled materials, and recycled asphalt, steel, and concrete will be used in the construction process.

Reduction in carbon dioxide levels as a result of the use of a specialized air induction system.

In announcing the St. Louis Lexus dealership project, the dealer noted that many of the design features were in fact mandated by Toyota, the parent of Lexus. According to Ray Mungenast, President of Dave Mungenast Lexus, the LEED dealership is “a sign of our ecological responsibility.” The Lexus dealership is aiming to achieve silver certification and reduce energy consumption by 18-20 percent.2

Dealerships as Good Solar P.V. Candidates

Due to their facilities’ functional requirements, auto dealers tend to have multiple contiguous spaces, generally resulting in spread out one-story buildings with large roof spaces. Single story buildings with large footprints make the best solar P.V. candidates since they can support large P.V. systems, thereby covering a major portion of the building’s underlying electricity needs. With the forthcoming widespread introduction of electric cars, dealers can use the increased P.V electricity generated for their new battery charging stations. Pursuant to the Emergency Economic Stabilization Act, the 30% solar credit was extended for eight years through December 31st, 2016. This means dealers can plan the timing of solar installations to correspond to their increased electric car recharging needs.

New Energy Tax Credits Just for Car Dealers

Section 30D of The American Recovery and Reinvestment Act provides a new minimum per-dealer tax credit of $2,500 for the sale of qualifying electric cars to tax exempt entities, including government agencies. The maximum credit can range between $7,500 and $15,000 depending on gross vehicle weight in combination with kilowatt battery capacity in excess of four kilowatts hours. It is anticipated that Federal, State and Local Government agency fleet purchasers are going to be some of the first movers on these car purchases. Automobile dealers will only be able to take this credit provided they make full disclosure to the tax exempt entity. This provision is clearly intended to create an economic transfer resulting in a lower purchase price to the tax exempt agency. Presumably, dealers located in Washington D.C. and state capitals will be major beneficiaries of this legislation.

This tax credit will give dealers with current taxable income an economic advantage and may require dealers with tax losses to consider restructuring and implementing other tax planning techniques.

Conclusion

The car dealership industry is increasingly using sustainability and energy efficiency as an important element of core marketing and branding strategies. Increasingly, some of these initiatives are becoming mandatory, making the potential for EPAct tax savings more common and probable. Electric cars require charging stations and dealers can use Solar P.V. tax credits to help meet the anticipated increased electricity generation needs.

References

1.Section 179(d) was extended for 5 years through December 31, 2013 by the Emergency Stabilization Act of 2008(P.L 110-343)

2.Phoenix Business Journal, “Mercedes-Benz Prepares to open LEED-Certified Dealership in Peoria,” Phoenix Business Journal, March 21, 2008

3.Evan Binns, “Mungenast to Build Area’s First LEED Car Dealership,” St. Louis Business Journal, March 7, 2008, available at www.stlouis.bizjournals.com/stlouis/stories/2008/03/10/focus11.html