About Energy Tax Savers

Energy Tax Savers, Inc. was started by Charles Goulding, Attorney/CPA/MBA, and Jacob Goldman, Engineer MBA/LEED AP, in late 2005 as soon as the Energy Policy Act (EPAct) legislation was enacted. Our first major commercial accounts were top 10 retail chains, supermarket chains and major manufacturers. Our first major government building design accounts were K-12 school architecture firms, engineering firms and leading ESCO's. Energy Tax Savers' first partners were the nations leading lighting and HVAC, manufacturers and installers, and now we are proud partners with numerous cost segregation firms and CPA firms.

Part of our core beliefs, is the importance of knowledge, collaboration and sharing. We are continuously asked to provide public speaking presentations on behalf of utilities, building equipment related trade shows, and professional organizations related to the lighting, HVAC and building envelope product and equipment industries, architects, engineers, CPA's, LEED professionals, real estate professionals and numerous other organizations. Also, we strive to share this knowledge through articles and guides, which we have published more of than any other firm.

About EPAct 179D

On August 8th, the Energy Policy Act of 2005 (EPAct) was enacted creating immediate potential tax savings for building owners or architects and engineers based on the use of energy efficient improvements. Section 179D outlines the requirements for a maximum potential tax deduction of up to $1.80 per square foot of affected spaces. In 2008, The Emergency Economic Stabilization Act extended the deduction period through December 31, 2013. The Protecting Americans from Tax Hikes Act of 2015 extended 179D through December 31, 2016. The Consolidated Appropriations Act of 2021, signed on December 27, 2020 extended 179D permanently.

Qualifications for EPAct 179D

Qualifying improvements must reduce the building’s energy use in at least one of three categories, lighting, HVAC, or building envelope to receive at least a partial deduction. The improvements must achieve a specified percentage reduction in energy usage compared to ASHRAE 90.1-2001 reference building code standards through 2015 and ASHRAE 90.1 2007 for 2016. Additionally the project must be certified by a properly licensed engineer or contractor upon completion.

The Benefits of EPAct 179D

The maximum deduction of $1.80/sq ft.

is comprised of three partial deductions: up to $.60/sq ft. for

lighting, HVAC, or building envelope each.

Candidates for EPAct 179D

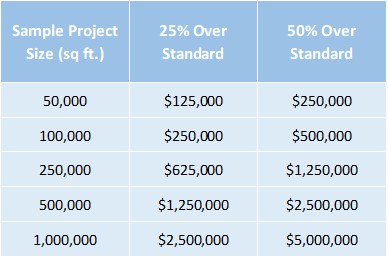

Ideal candidates for EPAct deductions are newly constructed buildings with at least 50,000 sq ft., renovation projects (particularly lighting retrofits), and regional or national chains that feature multiple locations.

In general, the commercial building owners are entitled to these one-time tax deductions, however, in the case of non-taxpaying building owners such as government building, EPAct allows the primary designer (architect/engineer/contractor) to obtain the tax incentives.

The Process for qualifying for EPAct 179D

The process of qualifying projects for the EPAct Section 179D deductions requires a detailed engineering analysis of building energy usage. For lighting projects our interdisciplinary tax experts and engineers can utilize architectural drawings and power plans to perform energy reduction and lighting density calculations. HVAC and building envelope projects, however, are generally more difficult as they require in-depth energy modeling.

Why Energy Tax Savers?

Energy Tax Savers, Inc. is one of the leading provider of Energy Policy Act (EPAct) tax services in the country. We are an interdisciplinary firm of employees with backgrounds specializing in tax law, accounting, engineering, and LEED certification.

Energy Tax Savers is a recommended EPAct service provider for leading lighting & HVAC companies. We represent many of the nations leading retailers, warehouse owners, aerospace companies, industrial manufacturers, financial service firms and car dealers. We also represent numerous architecture, engineering, design & build firms, and lighting designers. Lastly, we are the premier publisher of literature on energy tax incentives.