EPAct 179D Permanently Extended

EPAct 179D: Save Energy, Save Taxes

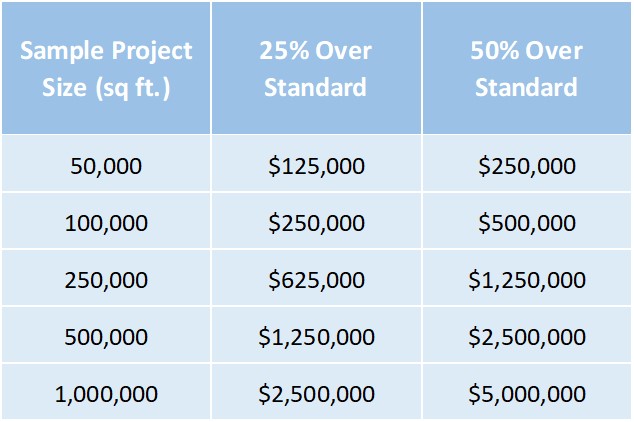

The Energy Policy Act of 2005 (EPAct) was enacted creating immediate potential tax savings for building owners or architects and engineers based on the use of energy efficient improvements. Section 179D outlines the requirements for a maximum potential tax deduction between $2.50 and $5.00 per square foot of affected spaces.

At Energy Tax Savers, we know how to apply the tax law to make building energy equipment investments more profitable. As the first green tax firm, we help our clients achieve federal tax incentives aimed at making energy efficient investment as economically viable as possible.

New EPAct 179D Rules and Guidelines Affecting 2023 Completed Energy Projects

The Benefits of EPAct 179D

Due to the recently-implemented Inflation Reduction Act, deductions can range from $2.50/sq ft to $5.00/sq ft.

Free Tax Benefit Assessments

Energy Tax Savers will review your project on a Complimentary Basis. Projects between 1/1/06 - Present are eligible. For new construction, we typically look for the Architectural, Mechanical, Electrical and Plumbing drawing sets in .pdf. For retrofits we look for information on the project, like project cost, spec sheets, energy saving estimates as well as the project address and any drawings (New or Pre-Existing). Upon completion of our complimentary review, we will estimate your project's tax deduction as well as provide you with a fixed fee quote for your project. We look forward to reviewing your project.