The EPAct Tax Aspects of Lady MAGA

Four of the world's leading rock star technology companies with numerous facilities include Microsoft, Amazon, Google and Apple, and are we what refer to as Lady MAGA. These businesses are characterized by large headquarters, many of which are located in California, office buildings, campuses, and huge data centers. In addition to common major facility categories, some of these tech giants have some large business-segment related facilities. Apple has its’ Apple retail stores, Google's Motorola acquisition requires manufacturing facilities, and Amazon has a large, leading-edge distribution center network. These businesses are growing and are currently involved in major expansion activities that provide the opportunity for building equipment purchases that can substantially reduce energy use while earning large energy tax incentives for doing so.

EPAct Tax Opportunity

The Energy Policy Act of 2005 (EPAct) provides an immediate tax deduction of up to $1.80 per square foot for building investments that achieve specified energy cost reductions beyond the American Society of Heating and Air-conditioning Engineers (ASHRAE) 90.1 -2001 building energy code standards. A one-time $1.80-per-square-foot deduction is the maximum tax deduction available, but deductions of up to 60 cents per square foot are also available for the three types of building systems: lighting, including lighting controls; HVAC; and the building envelope, which includes roof, walls, windows, doors and floor/foundation (everything on the perimeter of a building that "touches" the outside world). To obtain a tax deduction of 30 cents per square foot for lighting, the wattage must be reduced by 25 percent from ASHRAE 90.1 -2001 levels. The maximum allowable tax deduction of 60 cents per square foot requires a 40-percent reduction in wattage for lighting.

The Potential EPAct Opportunities for the Lady MAGA Companies

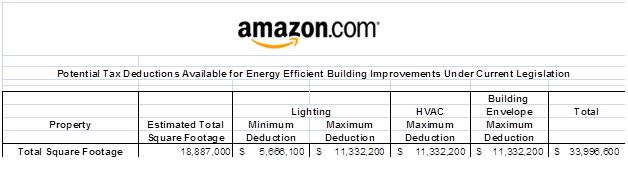

Each of the four Lady MAGA companies has published square footage data in their 2010 SEC 10-K annual financial report. The following charts illustrate the EPAct tax savings potential for each company based on their publicly reported total square footage.

Recent Acquisitions: The Emerging Lady MAGA Real Estate Trend

The past two years have seen a major uptick in the scope and diversity of real estate holdings of each of the Lady MAGA companies. For instance, in October 2011 Google purchased a 240,000 sq. ft. building near its headquarters in Mountain View, California. That acquisition came quickly on the heels of an August 2011 transaction whereby the tech giant entered into a lease for a 716,000 sq. ft. office building in Sunnyvale, California. On the other side of the country, 111 Eight Avenue in New York City is a 2.9 million sq ft. office tower that Google purchased in late 2010. On top of these primarily office acquisitions, Google has many large-scale data centers throughout the country in order to process. All told, these buildings add up to the over seven million square feet around the country, square footage that is primed for major energy retrofits and tax savings.

Amazon just moved into a 13 building corporate office and has numerous large U.S. warehouses that is uses as fulfillment centers for its online customers. Amazon's continued expansion underscores the increasing importance of the Lady MAGA companies to the nation's economy, as the demand for online products and services has not slowed down in the face of the economic downturn.

On top of a tremendous data center that Apple opened a few years ago in Maiden, North Carolina, the tech giant, which is the most valuable company in the world, has proposed a new "spaceship" office building in Cupertino, California, to be known as "Apple Campus 2." The proposed headquarters, which is all but guaranteed to be built over the next few years, is going to function as a small city including everything from a fitness center to its own power plant. and date centers. At a total of 2.8 million square feet, the campus will need to include highly energy-efficient systems to keep operational expenses to a minimum.

One of the most energy intensive processes that each of the Lady MAGA companies must account for is data processing. The below chart illustrates the square footage of some of each company's data processing centers along with the tax saving potential for each company.

Conclusion

Their tremendous financial strength and current growth initiatives provide the Lady MAGA technology companies with large scale energy cost reduction and tax savings opportunities. The activities of these companies are widely followed and they themselves are communication experts so their accomplishments should serve as examples for numerous other facility owners.