EPAct 179D Tax Savings for Hospitals

The recent U.S. health care system debate has focused a lot of attention on the high cost of hospital care in the country. Energy costs are one of the larger controllable costs in hospitals. It is estimated that U.S. hospitals spend over $6.5 billion annually on energy costs which, is equal to about 15% of hospital profits.

Recognizing this huge opportunity in the hospital energy cost area, the U.S. Department of Energy (DOE) recently announced the Hospital Energy Alliance (HEA) to help drive energy efficiency in hospitals. As result of their 24/7 operation, patient comfort and other needs, hospitals use about 2.5 times the amount of energy as similar sized commercial buildings. It is well recognized that as a group, hospitals are well behind other building categories in addressing energy reduction. Derek Wagner, EcoMagination leader of GE Healthcare, noted that for many years hospitals did not take energy efficient measures simply because the hospitals saw no need to improve. Things have changed recently however, as Wagner claims "while other sectors have led the way in becoming greener, in the past few years hospitals have really come along."1

Lighting

Upgrading lighting is one of the easiest major energy reduction categories for hospitals to act on. For-profit hospitals are eligible for up to 60 cent per square foot tax deductions under the Energy Policy Act (Section 179(D)), for energy efficient lighting. All government hospitals, including VA (veterans administration) hospitals, state and city hospitals and county hospitals, can generate Section 179(D) tax deductions for the architect's, engineers, lighting designers and design and build electricians that design qualifying energy efficient lighting. There are exciting new lighting products for hospital and health care facilities that are bacteria and infection resistant. For example GE lighting has developed series of germicidal fluorescent lamp that can be used for sterilization. These lamps are being used in the healthcare sector, laboratories, and even commercial buildings.2

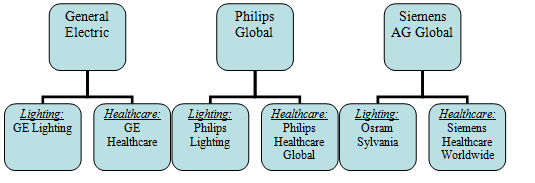

Three of the world’s largest lighting manufacturers, Philips, General Electric, and Siemens, also have major healthcare divisions within their respective companies that focus primarily on products for the healthcare sector, as follows:

Hospitals should benefit from the national account cross selling and financing available from these three larges industrial group sellers of lighting products.

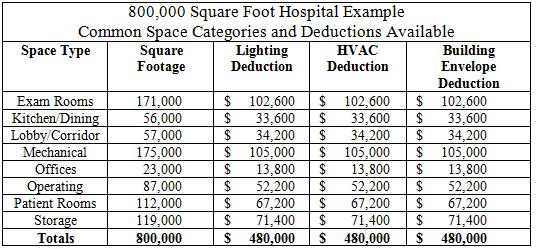

The deductions available for lighting range from 30 cents a square foot to 60 cents a square foot. The following table shows what type of Section 179(D) EPAct deduction a hospital may be eligible for in its variety of spaces:

HVAC

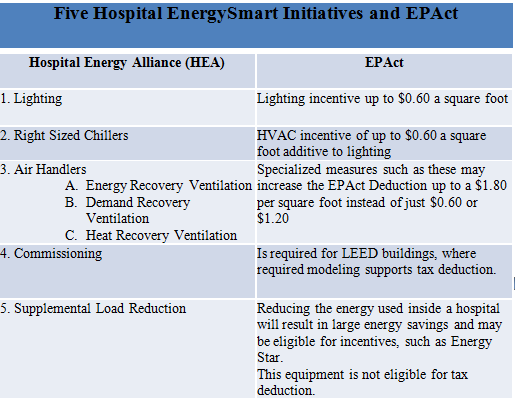

For profit making hospitals and designers of government hospitals HVAC can also generate large Section 179(D) tax deductions. To achieve Energy Star status demonstrating energy efficiency accomplishment, the U.S. government recommends that hospitals address five energy items, including two HVAC items. The five measures are 1) lighting, 2)right sized high efficient chillers, 3) air handling equipment, 4) commissioning, and 5) supplemental load reduction.

The following table lists the tax incentives available for certain energy efficient measures that hospitals can take:

The emphasis on right-sizing (fit the chiller to size of the building based on energy performance requirements), a chiller is a perfect interface for tax savings, since the optimal way to right-size and select a chiller is to model a building using building energy simulation software and the HVAC EPAct tax deduction also requires building energy simulation modeling in IRS approved software.

The emphasis on air handling equipment is also crucial for hospitals since it is particularly important for hospital's to replace or ventilate existing air with fresh outside air. Air handling equipment includes heat recovery ventilation, energy recovery ventilation and demand recovery ventilation. These are all good techniques to improve air quality, reduce energy costs, and help generate EPAct HVAC tax deduction.

Commissioning is the process of insuring that all of the building’s energy systems are calibrated and performing as they should. Supplemental load reduction involves measures to reduce other electrical loads which in hospital can be kitchen equipment, TV's, computer monitors, laundry equipment, MRI and laboratory equipment.

Hospitals are also excellent candidates for special purpose HVAC measures that can greatly reduce energy costs and qualify for large EPAct HVAC tax deductions. Such measures include thermal storage and geothermal. Thermal storage systems that make ice at night and cool a building down during the day are able to use so called “time of day pricing,” and purchase electricity at night when it is generally much cheaper than a daytime electricity purchase. Geothermal systems will often qualify for large EPAct tax deductions and for commercial purchasers, there is a 10% credit or 10% grant under IRC Section 48.

Building the LEED Way

One way for hospitals to attain energy efficiency and recognition for going green is building to LEED standards. LEED (Leadership in Energy and Environmental Design), developed and administered by the U.S. Green Building Council (USGBC), is a set of standards for environmentally sustainable construction. In 2007, the USGBC and Green Guide for Health Care (GGHC) entered into a partnership to develop tools, educational programs, and other activities and functions to support the health care industry’s efforts to go green.3

In 2009, the Dell Children’s Medical Center of Central Texas became for first hospital in the world to achieve LEED status. Being a not-for-profit hospital, it is ineligible for any kind of tax incentives, but the building and measures taken are a good example of what type of design would generate tax incentives available to energy efficient buildings.4

Conclusion

The overall mandate to reduce medical costs, along with U.S. federal government sponsored initiatives to reduce hospital energy costs, means that hospital energy management is getting a lot of attention. A variety of tax incentives can be used to support these initiatives which can be helpful to all Americans.

References

1. Environmental Leader. “Hospitals Due for Energy Efficiency Overhaul.” Environmental Leader, July 27, 2009.

http://www.environmentalleader.com/2009/07/27/hospitals-due-for-energy-efficiency-overhaul/

2. GE Consumer & Industrial Lighting. UV Lamps for Germicidal Applications. GE Brochure.

3. Holowka, Taryn. “USGB & GGHC Working Together to Green the Healthcare Industry.” USGBC News Release. http://www.usgbc.org/Docs/News/USGBC%20GGHC%20112907.pdf

4. Bloxm, Claire. “Dell Children’s Hospital of Central Texas Receives LEED-Platinum Certification from the U.S. Green Building Council.” Talk Medical. March 2, 2009. http://talk.news-medical.net/profiles/blogs/dell-childrens-hospital-of