EPAct 179D Tax Savings for Commercial Heaters

As a result of recent technology changes, warehouses, industrial plants, car dealers and auto repair garages and other commercial facilities located in the coldest U.S. states are now able to achieve substantial heating energy cost reduction supported by large Energy Policy Act (EPAct) Section 179 (D) tax deductions.

Most warehouses, industrial facilities, car dealers and auto repair garages, in the colder winter states, have heating systems without air conditioning. The colder winter states, with many of these facilities, would include Minnesota, Wisconsin, Michigan, Illinois, Indiana, Ohio, Pennsylvania, New Jersey, New York, Northern California and the New England states.

EPAct Tax Provisions

Pursuant to Section 179 D of the Energy Policy Act (EPAct) and its underlying ASHRAE (American Society of Heating Refrigeration and Air Conditioning) building energy code, commercial buildings are eligible for energy efficiency tax deductions of up to $1.80 per square foot. If a building’s energy reducing investment doesn't qualify for the full $1.80 per square foot deduction, deductions are available for any of the three major sub-systems, including:

1. Lighting

2. HVAC (Heating, Ventilation and Air Conditioning) and

3. The building envelope

Each component can qualify for up to 60 cent per square foot EPAct tax deductions. The building envelope is anything on the perimeter of the building that touches the outside world including roof, walls, windows, doors the foundation and related insulation layers.

Technology Improvements

For most of these “Heat Only Spaces” (HO Spaces), the largest building energy costs item are first lighting and second, the heating system. Lighting typically makes up 50% to 70% (or even a greater percentage) of total building energy costs. The good news is that as result of new energy efficient lighting technology, most of these facilities either have or are in the process of installing highly energy efficient lighting. In fact, to date HO Spaces have been the largest beneficiaries of the EPAct lighting tax incentive.

“Space heating and lighting consume most of the energy in non-refrigerated warehouses. Installing more efficient lighting to save electrical energy is a popular and first step but what about the gas-fired heating?” Ken Williams, Director of Marketing, Cambridge Engineering

Improved Commercial Heaters

New improved commercial heating systems can provide 8% and even greater percentages of energy cost savings as compared to the ASHRAE 2001 building code standards.

There are multiple heater technologies suitable for the HO Spaces market, including direct fired gas heaters, unit heaters, and infrared (radiant) heaters. One of the more popular highly energy efficient heaters are the Cambridge Engineering direct gas fired blow-thru space heaters. The Cambridge units have been selected by the Environmental Protection Agency and Department of Energy as an energy partner to help save energy in commercial and industrial buildings. Besides having a very high efficiency, these units use natural gas as a fuel source, and natural gas is abundant in the U.S. and actually experiencing declining prices.

“Installing more energy efficient warehouse heating systems represent a tremendous opportunity to save energy, reduce carbon emissions and significantly lower operating costs.” Ken Williams, Director of Marketing, Cambridge Engineering

Property owners in the colder winter regions should consider both upgrading their lighting if they haven't done so, and installing these new heating systems as soon as practicable and before the expiration of the EPAct tax deduction incentives (which expire January 1, 2014).

Combining EPAct Tax Deduction Incentives

The way to optimize the energy and tax savings results, is by combining energy planning with tax planning. Tax departments and tax advisers, particularly those with warehouses, industrial plants and auto repair facilities, should first work with their facilities and energy planning departments to identify all HO Spaces and determine energy costs related to lighting and heating. When either or both of those costs are high (companies with multiple facilities should compare facilities), or near or below ASHRAE 2001 building energy codes levels, there will most likely be a major economic opportunity. Whenever warehouse lighting exceeds 0.60 watts per square foot there is an opportunity for both energy cost savings and large EPAct tax deductions.

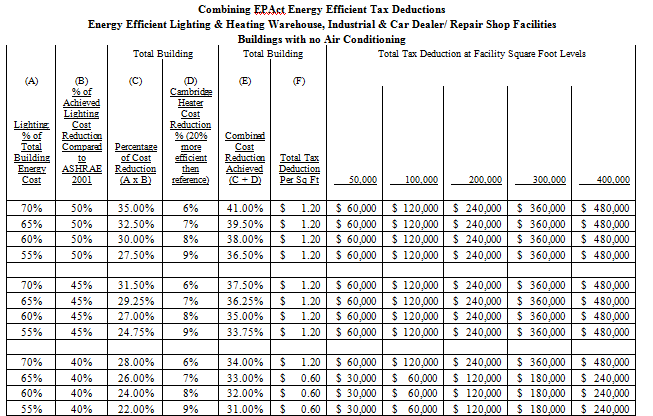

The following table illustrates how energy efficient lighting and energy efficient heaters combine to produce enhanced EPAct tax deductions for the HO spaces.

Most utilities offer rebates for lighting upgrades and many gas utilities offer rebates for gas heater upgrades. With combined lighting and heater projects many utilities will offer additional bonus rebates for two or more energy reducing initiatives.

Benefiting from Prior Energy Efficient Lighting Investments

Since the enactment of EPAct tax incentives effective January 1st, 2006 thousands of warehouses, industrial buildings and auto repair facilities have already upgraded to energy efficient lighting. Some of these property owners may have already upgraded their lighting pre January 1, 2006. All those who upgraded pre January 1, 2006, or may have missed taking some or all of the 60 cent per square foot lighting EPAct tax deduction, may be able to obtain up to a $1.20 and in some cases to a $1.80 per square foot tax deduction by upgrading their heating systems.

Conclusion

The section 179(D) EPAct tax incentives were shrewdly designed to encourage property owners to take a comprehensive multifaceted approach to building energy cost reduction. Property owners who understand how the rules integrate to for Heat Only buildings with energy efficient lighting now have the opportunity to greatly reduce their heating bills potentially supported by enhanced utility rebates, falling natural gas prices and large section 179(D) EPAct tax deductions.