HVAC Drives Large Tax Deductions

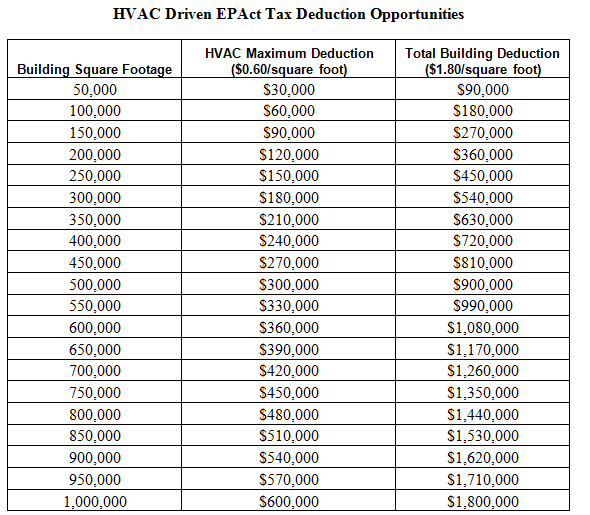

The continuous improvement in HVAC (Heating, Ventilation and Air Conditioning) system energy efficiency is now driving large immediate tax deductions for numerous property owners. Under the Energy Policy Act (EPAct) IRC Section 179D effective January 1, 2006 through December 31st 2013, there is an opportunity for an immediate first year tax deductions of 1) 60 cents per square foot for qualifying HVAC systems, 2) $1.80 per square foot whole building tax deductions which are typically driven by very efficient HVAC.

The magnitude of these opportunities is presented in the following building square footage chart.

Overview

IRC Section 179D provides for three separate 60 cent per square foot immediate tax deductions for energy efficient lighting, HVAC and building envelope investments when compared to a 2001 ASHRAE (American Society Heating Refrigeration Air Conditioning Engineers) building energy code standard by building category.

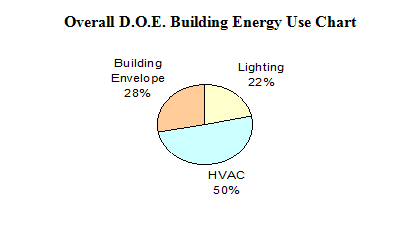

During the first three years the EPAct legislation was effective from January 1, 2006 through December 31, 2008 we saw a tremendous amount of qualifying lighting projects and only a handful of qualifying HVAC and whole building projects. This was because the qualifying lighting products were market ready and the process for obtaining lighting tax deductions was familiar to the lighting industry. This was somewhat disappointing since HVAC is the largest energy user and almost twice that of the two other building categories meaning lighting and building envelope. The following pie chart provided by the Unites States Department of Energy makes it clear how important energy efficient HVAC is to managing energy use:

The Magnificent HVAC Seven

We are now seeing seven categories of HVAC projects triggering HVAC and whole building tax deductions:

1. Highly Efficient Right Sized Systems

If all major components of the HVAC system are at the highest energy efficiency level meaning A. the basic package unit or chiller are high efficiency units, B. there are VFDs (variable frequency drives) to minimize energy use on all key motors C. there is a comprehensive HVAC control system and D. most importantly, the system is sized right (fitted properly), then we are seeing core HVAC systems qualify.

2. Thermal Storage Systems

Thermal storage systems essentially make ice that can be stored and used to cool buildings. These systems will typically qualify for EPAct in electricity markets that use time of day pricing. With time of day pricing and thermal storage, electricity is purchased at night when it is substantially cheaper, this night-time electricity is then used to create ice and the resultant ice is used to cool the building during the day when electricity rates are much higher. These systems are much more likely to qualify for EPAct when used in conjunction with the highly efficient systems described in number 1 immediately above.

3. Decentralized systems

Decentralized systems use smaller systems to handle the building’s day to day normal energy use instead of having one large system. Coupled with occupancy sensors, these smaller decentralized systems can turn on and off based on the individual occupancy of the spaces. There is no better energy savings than a system that can be turned off... Due to the ability to individually control spaces, decentralized systems normally use much less energy than traditional centralized systems

4. Heat Recovery Ventilation

Heat Recovery Ventilation uses heat exchangers to heat or cool incoming fresh air, with the outflowing waste air, thereby recapturing 60 to 80 percent of the energy that would other wise be lost.

5..Geothermal Heat Pumps

Geothermal systems use the natural , stable temperature of the shallow(within 10 ft of the surface) earth to provide heating in winter and/or cooling in summer. Geothermal heat pumps use the transfer of heat in contrast to typical heating devices that utilize the combustion of fuels. The reduction in fuel use is where geothermal heat pumps dramatically save on annual energy costs.

6. Demand Control Ventilation

Demand Recovery Ventilation enhances ventilation by re ventilating outside air based on human occupancy CO2 levels. The concept is to re ventilate by human presence and not by physical space. The energy savings results from not blowing in fresh air or conditioning a space when humans are not present in the space.

7. ASHRAE Building Size Standards

Whenever a building is below certain square footage breakpoints such as 150,000 square feet and 75,000 square feet the use of particular technologies will trigger EPAct. For example installing highly energy efficient chillers in a building of less than 150,000 square feet will often trigger EPAct tax deductions because the building it will be compared to will be a 2001 ASHRAE reference building which will be cooled by less efficient package units.

Building Computer Simulation Modeling Requirement

To qualify for the HVAC immediate 60 cent per square foot deduction or the $1.80 whole building tax deduction the required level of energy reduction must be documented with an approved IRS building energy model. The HVAC must show at least a 16.67% energy cost reduction and the whole building must show at least a 50% energy cost reduction compared to ASHRAE 2001. These energy models are also required for LEED building projects. LEED stands for Leadership in Energy and Environmental Design, and is the marquee sustainable building certification program operated by the U.S. Green Building Council.

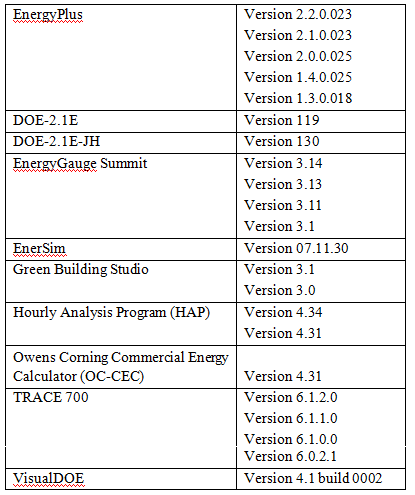

A list of the IRS approved energy models is as follows:

Tax Planning-Recognizing the Big Five

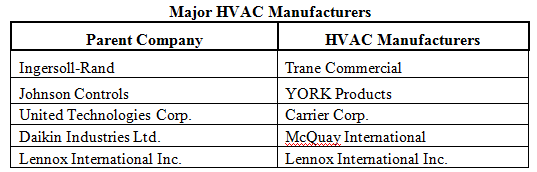

With all new building projects and whenever HVAC is upgraded the tax department should recognize that a major tax deduction opportunity may be available. In the HVAC industry the big five equipment suppliers are Carrier, McQuay, Trane, York, and Lennox. Four of the big five are now owned by larger industrial companies as follows:

Two of the big five, namely Trane and Carrier, have had their own versions of EPAct qualifying building energy modeling software approved by IRS(Trane TRACE and Carrier HAP).

Conclusion

Continuous Improvements in existing HVAC equipment and new HVAC products and technologies are presenting major new tax opportunities. Tax departments will benefit from understanding who the big five are in the HVAC industry and recognizing when equipment potentially eligible for tax deduction is purchased.