The Energy Tax Aspects of California's 3 T Economic Recovery

Introduction

The California economy has been rebounding surprisingly well with strong growth in the three leading California “T” business sectors, namely 1. Trade, 2.Tech, and 3. Tourism. The building facilities in these three categories have some facility-specific, large energy cost and energy tax savings opportunities. California property owners are particularly well-platformed for larger EPAct tax deductions because of the state's longstanding commitment to more rigorous building energy codes and expanding mandatory building energy benchmarking requirements. This article is intended to help tax advisers with California facilities identify both the related building categories and the applicable energy tax opportunities.The EPAct Section 179D Tax Opportunities

Pursuant to Energy Policy Act (EPAct) Section 179D, commercial property owners in California making qualifying energy-reducing investments in their new or existing locations can obtain immediate tax deductions of up to $1.80 per square foot.If the building project doesn't qualify for the maximum EPAct Section 179D $1.80 per square foot immediate tax deduction, there are tax deductions of up to $0.60 per square foot for each of the three major building subsystems: lighting, HVAC (heating, ventilating, and air conditioning), and the building envelope. The building envelope is every item on the building's exterior perimeter that touches the outside world including roof, walls, insulation, doors, windows and foundation.

Alternative Energy Tax Credits and Grants

There are multiple 30% or 10% tax credits available to California property owners in the 3 T building categories for a variety of alternative energy measures with varying credit termination dates. For example the 30% solar tax and fuel tax credits expire January 1st 2017 and the 10% Combined Power tax credit also expires January 1st 2017. The 30% closed loop and open loop biomass credit expires January 1st, 2014.All alternative measures that are eligible for the 30% and 10% tax credits are also eligible for equivalent cash grants for the three years staring January 1st 2009 and ending December 31st 2011.

Unique 2011 Opportunity: Enhanced Bonus Tax Depreciation

The credits described above are ordinarily eligible for a 5 year MACRS depreciation, but building owners who install these renewable energy systems after September 8, 2010 through December 31, 2011 can take 100% depreciation tax bonus immediately. Even if building owners miss this 2011 window, they can enjoy a 50% tax depreciation bonus on alternative energy equipment placed in service from January 1, 2011 through December 31, 2012.California's Building Energy Code

California's state-developed code, 2008 Building Energy Efficiency Standards, comprising Title 24, Parts 1 and 6, of the California Code of Regulations, is mandatory statewide. Effective as of January 1, 2010, the code is more stringent than ASHRAE 90.1 2007, thereby making California properties ideally platformed to achieve EPAct tax deductions. By making their buildings incrementally more efficient than what is minimally required by building code, owners of properties in one of the three T's should be poised for large tax incentives.CALGreen, as the code has come to be known, sets a threshold of a 20 percent reduction in indoor water and energy use and includes voluntary goals for reductions of 30 percent, 35 percent and 40 percent. Additionally, it mandates inspections of energy systems -- such as heating, air conditioning and mechanical equipment -- for commercial buildings that are larger than 10,000 square feet to "ensure that all are working at their maximum capacity according to design efficiencies." Thus, California's policy aims and guidelines mirror the federal requirements mandated by EPAct 179D, while simultaneously integrating a LEED-style approach towards building design. LEED certification is the widely renown marquee standard for recognizing sustainable buildings and has become an essential criteria for claiming Class A building status. LEED buildings have a distinct tax advantage in that due to their already documented energy reduction achievements many LEED buildings will qualify for a $1.80 EPAct tax deduction with the right building designs.

Benchmarking Laws

In previous articles, the authors have analyzed the impact of mandatory energy benchmarking and disclosure on the commercial real estate market in New York City. San Francisco's Board of Supervisors, responsible for overseeing the energy performance of commercial buildings within the city, recently unveiled a benchmarking plan on par with New York City's. The newly adopted “Existing Commercial Building Energy Performance Ordinance” requires commercial property owners to measure and rate, or “benchmark” the energy performance of their buildings and make energy ratings available to the public. The ordinance also requires owners to conduct energy audits every five years.San Francisco is not alone among major California cities requiring benchmarking audits. The entire state has adopted a mandatory benchmarking policy for commercial properties. Benchmarking is an effective first step towards creating an energy efficient commercial property sector because it requires property owners to maintain a highly efficient building in order to attract potential tenants or purchasers. It also allows building owners to identify cost-effective energy efficient solutions as compared to comparable properties, which can be monitored and adjusted in real time. Against the backdrop of required energy benchmarking, building owners ought to invest in the necessary energy efficient upgrades to achieve energy reduction targets eligible for EPAct 179D tax incentives.

Opportunities for the 3 T's

California's Trade Sector

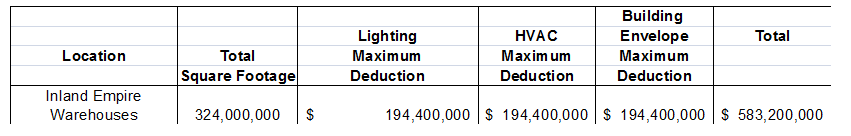

California's trade warehouse facilities and distribution sector combine for millions of square footage of property that can drive huge EPAct tax deductions. For instance, the Inland Empire in Southern California consists of over 324 Million square feet of industrial and warehousing space, involved in distributing merchandise from the Los Angeles and Long Beach seaports to the rest of the country. The managers of the Inland Empire have recently embarked on a mission to reduce their energy consumption in recognition of the heavy strain the distribution corridor and that region places on local energy infrastructure. The following chart illustrates the EPAct tax savings potential of the Inland Empire project:

From an energy management standpoint, warehouses are generally categorized as unconditioned, meaning no HVAC, or conditioned, meaning the facility has HVAC. Conditioned warehouses may have cooling capability, indicating refrigeration or freezer equipment. From a building energy perspective, the distinction between unconditioned and conditioned is crucial, as conditioned buildings are required by building code to have more energy-efficient building envelopes (including roofs) and higher levels of insulation.

With unconditioned warehouses, building lighting comprises the primary building energy use. Most warehouses that have not had a lighting upgrade to energy efficient lighting in the last seven or eight years utilize prior generation metal halide or T-12 fluorescent lighting. It is also important to realize that effective January 1, 2009, most probe-start metal halide lighting may no longer be manufactured or imported into the United States and effective July 1, 2010; most T-12 lighting may no longer be manufactured or imported into the United States. This means that warehouses that still have this lighting technology will soon be subject to large price increases for replacement lamps and bulbs.

With conditioned warehouses, energy management includes the lighting cost reduction opportunities described above plus the ability to obtain substantial energy cost reduction through building envelope and HVAC improvements. Energy managers who are building new construction or retrofitting existing conditioned warehouses should strongly consider engaging tax and engineering firms with computer energy simulation modeling capability. With an IRS- approved model, the engineering firm can help the warehouse owner optimize the utilization of energy efficient equipment to reduce energy operating costs and maximize EPAct tax deductions and utility rebates, particularly in local jurisdictions that provide utility rebates for highly energy efficient HVAC, roofs, insulation, refrigeration and freezer equipment.

California's Technology Sector

As a result of their multiple buildings, large square footages and central energy systems, many technology companies – ranging from Internet and computer hardware firms to biotech manufacturers and consumer electronics – have facilities that are eligible for special tax savings opportunities. Virtually every “tech campus” should be able to use the existing attributes of their central plant systems, whether upgrading office space, research and development facilities, or manufacturing facilities, to easily capture large energy related tax savings.Typical technology campuses are located in densely populated, expensive energy cost areas since the engineers, scientists and laboratory technicians are highly skilled workers who need to be in areas with strong university and other research resources. To begin the energy tax planning process, tax departments should first obtain a list of campus facilities organized by square footage and building type. Smaller buildings supported by the central plant at less than 150,000 square feet and less than 75,000 square feet more easily qualify for EPAct tax deductions. The buildings at many California tech campuses are primarily utilized as laboratories and offices, since product manufacturing is often subcontracted out to contract manufacturers and other low-cost jurisdiction facilities.

Northern California's “Silicon Valley” has produced several notable biotech, computer, and consumer technology firms, many of which have large research and/or office facilities in the region. Environmental and energy watchdogs like the Sierra Club and Greenpeace shine a particularly strong spotlight on these firms. Recently, Greenpeace attacked Apple for its lack of energy efficiency measures at one of its data processing center, labeling it a “dirty data” center. In the same report, Greenpeace noted that some tech companies, like Google, Yahoo, and Amazon, have effectively mitigated their contributions to global warming by their facilities' utilizing energy efficient design techniques and cleaner burning alternative energy sources.

Greenpeace has spoken out on the need to disclose each company's energy consumption, especially their “cloud computing” centers, a topic the authors have previously addressed. Greenpeace argues that increased energy transparency will facilitate a race towards efficiency in the face of burgeoning consumer concerns about their energy consumption, and cites estimates that data center energy demand already accounts for 1.5-2% of world electricity consumption, set to quadruple over the next ten years, as reason for all tech companies to act now. Not only can these companies take advantage of EPAct tax deductions, but they can use alternative tax credits to support large investments in alternative energy.

For example, Mountain View, California based Google has made $400 Million in solar and wind investments along with geothermal and fuel cell installations in recognition of the fact that its data processing centers use huge amounts of power. Google is putting $55 Million towards financing a wind farm in California's Techapi Mountains, from which they will be able to draw power, while also making ambitious investments to generate electricity across the country, including a $168 Million solar thermal energy project in the Mojave Desert. As far back as 2008, Google invested over $10 Million in cutting-edge enhanced geothermal cooling systems, and it continues to stay at the forefront of the energy market, as the company purchased fuel cells in early 2010.

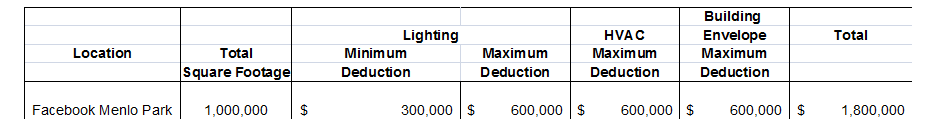

The newest tech giant in California is Facebook. Below is an example of the EPAct tax savings potentially available to Facebook, should the company decide to make its recently purchased facility located in Menlo Park, California energy efficient at or above EPAct levels:

Facebook EPAct Tax Incentive Opportunity

California's Tourist Sector

California is America's most popular tourist destination. Hotels get special privileged treatment under the EPAct tax provisions. The underlying rule set to qualify for the Sec. 179D lighting tax deduction makes hotels and motels the most favored property category for the tax incentives for lighting. The rule set requires at least a 25-percent watts-per-square foot reduction as compared to the 2001 American Society of Heating Refrigeration and Air Conditioning Engineers (ASHRAE) building energy code standard. Full tax deduction is achieved with a 40-percent watts-per-square foot reduction compared to the ASHRAE 2001 standard. The ASHRAE 2004 hotel/motel building code standard requires 41 -percent wattage reduction, which means that any hotel or motel lighting installation that meets that building code requirement will qualify for the maximum EPAct lighting tax deduction.Conclusion

California's rapid economic rebound is timed perfectly with energy product developments particularly for LED lighting and Solar P.V., and the energy tax provisions. Tax advisers with property owners in the 3 T property categories need to meet with their clients sooner rather than later if they are going catch this California wave.References

Charles Goulding, Taylor Goulding and Amelia Aboff, “How LEED 2009 Expands EPAct Tax Savings Opportunities,” Corporate Business Taxation Monthly (September 2009), at 11.

Charles Goulding, Jacob Goldman and Joseph Most, “Using EPAct Incentives to Enhance New Mandatory Building Energy Disclosure Requirement,” Corporate Business Taxation Monthly (October 2010), at 11-12.

Sustainablebusiness.com, “San Francisco Mandates Benchmarking for Commercial Buildings,” available at: http://www.sustainablebusiness.com/index.cfm/go/ news.display/id/21860.

Charles Goulding, Jacob Goldman, and Malcolm Thomas, “The Energy Tax Aspects of Warehouses and Distribution Centers,” Corporate Business Taxation Monthly (October 2009, at 16.

Id.

Charles Goulding, Amelia Aboff, and Taylor Goulding, “Special Tax Savings Opportunities for Pharmaceutical and Biotech Campuses,” Corporate Business Taxation Monthly (October 2009), at 14.

Charles Goulding, Jacob Goldman, and Cassandra Gengler, “The Tax Aspects of Cloud Computing and Data Centers,” Corporate Business Taxation Monthly (December 2010).

Charles Goulding, Jacob Goldman and Raymond Kumar, “Advanced EPAct Tax Planning for Hotel Chains,” Corporate Business Taxation Monthly (June 2010), at 14.

Charles Goulding, Jacob Goldman, and Taylor Goulding, “Hotels and Motels Most Favored Energy Policy Act Tax Properties,” Corporate Business Taxation Monthly (March 2009), at 17.