Massachusetts 25 Percent Emissions Reduction Plan Provides Tax Opportunities

On December 29th, 2010, Massachusetts announced a plan to reduce greenhouse gas (GHG) emissions by 25% below the 1990 standards over the next 10 years. This announcement comes on the heels of California’s similar announcement on December 16th, 2010 with a plan to reduce current emission back to the 1990 levels. Tax advisers can be of great assistance to Massachusetts companies striving to meet these ambitious goals.

Tax Opportunities

Pursuant to Energy Policy Act (EPAct) Section 179D, buildings making qualifying energy-reducing investments in their new or existing locations can obtain immediate tax deductions of up to $1.80 per square foot.

If the building project doesn't qualify for the maximum $1.80 per square foot immediate tax deduction, there are tax deductions of up to $0.60 per square foot for each of the three major building subsystems: lighting, HVAC (heating, ventilating, and air conditioning), and the building envelope. The building envelope is every item on the building’s exterior perimeter that touches the outside world including roof, walls, insulation, doors, windows and foundation.

Alternative Energy Tax Credits and Grants

There are multiple 30% or 10% tax credits available for a variety of alternative energy measures with varying credit termination dates. For example the 30% solar tax credit expires January 1st 2017 and the 10% Combined Power tax credit also expires January 1st 2017. The 30% closed loop and open loop biomass credit expires January 1st, 2014.

All alternative measures that are eligible for the 30% and 10% tax credits are also eligible for equivalent cash grants for the three years staring January 1st 2009 and ending December 31st 2011.

Enhanced Bonus Tax Depreciation

The Tax Relief, Unemployment Insurance Reauthorization, and Job Creation Act provides for 100% tax depreciation bonus for equipment placed in service after September 8th 2010 and through December 31st 2011. For equipment placed in service after December 31st 2011 and through December 31st 2012, the new law provides for 50% tax depreciation bonus.

Massachusetts versus California Plan

In comparison to the California plan , the Massachusetts plan relies largely on existing programs such as renewable energy mandates and commercial building efficiency standards . These programs focus on exactly the same areas that are emphasized by the Federal tax incentives defined earlier. Recognizing that one-third of the Massachusetts emissions come from the transportation sector, the state is starting a pilot "pay as you drive" program that will reduce car insurance premiums based on miles driven. The federal tax system also contains major tax incentives for electric vehicles and battery charging systems which should help this initiative .

Utility Electricity Generators

Including the electrical utilities in the initial 2012 compliance group should

kick start the program since utilities are quite familiar with the available emission reduction

solutions and can utilize a variety of special tax incentives, some tailored for their industry to implement the necessary solutions. For example, utilities can now take advantage of the 30% tax credit for large scale wind and solar PV installations at customer locations. These transactions help both the utility and the customer. The utility meets some of its cap and trade obligations and the customer locks in lower than market electricity cost for an extended time period.

Coal fired utilities are one of the biggest emissions generators. As a solution to reduce coal plant carbon dioxide emissions, a company can replace coal with biomass. Southern Company has already engaged in biomass conversion projects, including a project with its Georgia Power subsidiary. Furthermore, Southern Company is evaluating converting five additional coal plants to biomass . Qualifying closed loop and open loop biomass projects completed before January 1st, 2014 are eligible for a 30% alternative energy tax credit. Qualifying closed loop and open loop biomass projects completed before January 1st, 2014 are eligible for a 30% alternative energy tax credit.

Cape Wind National Grid Power Purchase Agreement

After many years of controversy, the Massachusetts Cape Wind project appears to be proceeding rapidly. In December 2010, National Grid, one of the major utilities covering a large portion of Massachusetts, received approval by the Massachusetts Department of Public Utilities for a 15 year Power Purchase Agreement (PPA) covering 50% of the electricity generation from this project. Some of the key terms as publicly reported include:

At costs projected to exceed 2 billion dollars the 30% 600 million dollar tax credit and deprecation tax benefits exceeding 1 billion dollars the tax benefits become critical.

The public disclosure indicates that the amount National Grid is willing to pay for the electricity generated will change based on securing the tax¬¬¬¬¬credit. If they secure the tax credit they are willing to pay more per Kwh for the electricity. Previously, in December 2009, National Grid signed a 20 year PPA with offshore wind developer Deepwater Wind to purchase power from a proposed offshore wind farm near Block Island, Rhode Island for 24.4 cents per kilowatt hour.

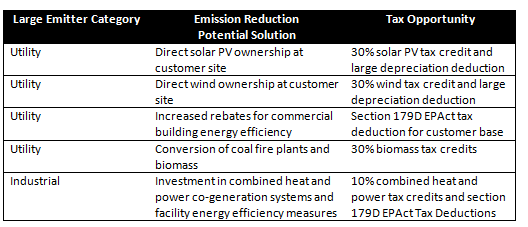

The following chart illustrates some of the tax effective strategies some of the Massachusetts emission generator categories can consider implementing:

Massachusetts GHG Plan

Tax Enhanced Emission Reduction Solutions

Massachusetts Targets CHP

Massachusetts has provided substantial economic incentives for combined heat and power (CHP) or what is commonly known as co-generation. The CHP program should be able to play a large role in meeting the Massachusetts GHG reduction goal. Among the nation’s leaders in incentivizing energy efficient investments, Massachusetts’ National Grid utility offers energy strategies, technical assistance and financial incentives to customers who are building new facilities, adding capacity for manufacturing, replacing failed equipment or undergoing major renovations. In particular, the state sees the value in encouraging CHP systems installation, as they are currently offering to pay up to 70% of the incremental costs for the high efficiency CHP materials and systems or buy down the incremental investment to a 1.5-year simple payback. Some rebates vary by capacity, building size or efficiency.

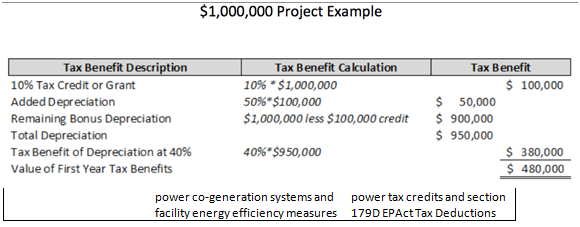

The following example illustrates the large tax incentives available for CHP projects accomplished after September 8th, 2010 and before December 31st, 2011:

Sample Combined Heat and Power Tax Savings from September 9, 2010 through December 31, 2011

Multiple Strategy Approach

The scope of emission reduction required is so great for some of these facilities that a variety of solutions over multiple years will be required.

Solution will include:

(1) Investments in existing properties to reduce emissions

(2) Shutting down all or a portion of high emission generation facilities

(3) Internal cap and trade – using the company’s own entities to reduce emissions

(4) External-third party cap and trade

The rules in this area are new and evolving. Facility owners will need to consult cap and trade experts and tax advisers who are closely monitoring developments in this area.

Concurrent Tax Planning for Massachusetts and EPA Guidelines

The same week after Massachusetts announced its plan, the Federal EPA announced its landmark plan also aimed at the nation’s largest GHG emitters. The agency said it will announce a common sense approach and similarly will propose standards for power plants in

July 2011 and refineries in December 2011. This means that the largest Massachusetts emitters in the targeted sectors should strive to implement solutions that simultaneously meet both the increased Federal and Massachusetts emission standards.

The Massachusetts Electric Vehicle Opportunity

Massachusetts has placed great emphasis on reducing emissions for the transportation sector and the speculation is they will follow California’s auto mileage standards. It should be noted that it may be harder for Massachusetts to use the transportation sector and electric vehicles to reduce emissions since California has a jump start on installing a much more extensive electric battery charging infrastructure.

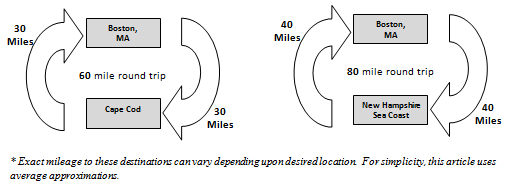

Commercial businesses in some of Massachusetts’ major vacation destinations may want to consider installing charging stations and the charging station tax credit to attract customers. This is necessary since some of the current electric vehicles have charging ranges as low as 40 miles.

For example, in Tennessee, where the Nissan leaf electric vehicle is being manufactured, Cracker Barrel (the road side restaurant chain) is installing charging stations at 24 Tennessee locations .

Here are some examples of popular Massachusettsdestinations from Boston and the round-trip miles:

The Power of the Internet and Massachusetts GHG Reporting

The internet has become an important tool in measuring and analyzing GHG emissions. For Massachusetts, the public can review two major categories of emissions reports called entity reports and facility reports.

Entity reports are reports where the public can review entity wide emissions as voluntarily disclosed by the reporting organization. Facilities reports are reports by individual facilities in Massachusetts that are required to report their emissions pursuant to state entity wide reports.

This means that as individual Massachusetts property owners manage down their emissions, the ever decreasing number of outliers will become increasingly visible.

Challenging Paradigms

Ian Bowles, the Massachusetts secretary of energy and environment, has thrown down the gauntlet challenging the naysayers by saying that, “people who have studied this find you can get your first 20-30 percent of greenhouse gas cuts without making significant economic trade-offs .”In then describing the Massachusetts plan, he continued that it “puts the lie to the Chicken Little-oriented debate on the national scene [that equates reduction of emissions with job loss and economic disruption]”. Bowles is confident that most of the planned emissions cuts would result in net gains in jobs statewide.

Conclusion

Massachusetts and the EPA are following the global trend and steadily seeking to curtail GHG emissions. The Massachusetts companies have variety of tax incentives they can use to help manage the process. Successful solutions will serve as case studies for the rest of the country confronting the same emission reduction obligations.

References

To be published by CCH: Goulding, Charles & Taylor Goulding. “Tax Opportunities for 360 California Companies’ Cap and Trade Compliance” Corporate Business Taxation Monthly.

Barringer, Felicity. "Massachusetts Sets Targets to Slash Carbon Emissions." NY Times. 29 Dec. 2010. <http://www.nytimes.com/2010/12/30/science/earth/30climate.html>

To be published by CCH: Goulding, Charles, Raymond Kumar and Taylor Goulding. “Providing Tax Advice for an Electric Car Enviornment” Corporate Business Taxation Monthly.

"Southern Company Breaks Ground on Biomass Plant." PR Newswire. 10 Nov. 2009. Web. 29 Dec. 2010. <http://www.prnewswire.com/news-releases/southern-company-breaks-ground-on-biomass-plant-69671882.html>.

"Cracker Barrel to Install Electric Car Charging Stations at Select Tennessee Locations." Convenience Store News. Stagnito Media, 30 Nov. 2010. <http://www.csnews.com/top-story-cracker_barrel_to_install_electric_car_charging_stations_at_select_tennessee_locations-57585.html>.

Barringer, Felicity. "Massachusetts Sets Targets to Slash Carbon Emissions." NY Times. 29 Dec. 2010. <http://www.nytimes.com/2010/12/30/science/earth/30climate.html>k