EPact 179D Tax Savings for Managed Buildings

The vast majority of large scale commercial real estate in the United States totaling billions in square feet is managed by the top real estate management companies. When it comes to utilizing Federal energy efficiency tax incentives available to the building owners, the presence of an intermediary real property manager whose energy initiatives impact the underlying owner has historically been a barrier but can easily be converted into large scale tax panning opportunity. The opportunity arises once the large real property managers understand the magnitude of the Energy Policy Act (EPAct) tax incentives available to owners and tenants, and set their retrofit efficiency targets at the Section 179D tax deduction levels or better.

The Large Real Estate Management Companies

The largest real estate management companies with a major presence in the U.S. include Cushman & Wakefield, Colliers International, CB Richard Ellis (commonly called CBRE) Jones Lang LaSalle, Trammel Crow, and Grubb & Ellis. These six firms manage well over 100 million of U.S. real estate each and collectively manage over 2 billion in U.S. property square footage.

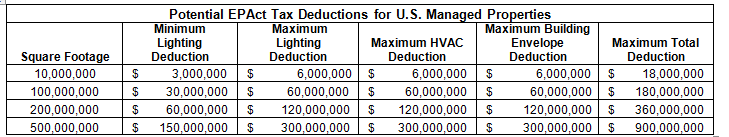

The magnitude of EPAct tax deductions potentially available to large-scale professionally managed portfolios is presented in the table below.

The EPAct Tax Opportunity

Pursuant to Energy Policy Act (EPAct) Section 179D, building owners or tenants making qualifying energy-reducing investments can obtain immediate tax deductions of up to $1.80 per square foot.

If the building project doesn't qualify for the maximum $1.80 per square foot immediate tax deduction, there are tax deductions of up to 60 cents per square foot for each of the three major building subsystems: lighting, HVAC (heating, ventilating, and air conditioning), and the building envelope. The building envelope is every item on the building’s exterior perimeter that touches the outside world including roof, walls, insulation, doors, windows and foundation.1

Real Estate Management Company Standard Setting

Lighting

In the lighting area, it is relatively easy for management companies to establish standards that will trigger large tax deductions for the underlying building owners.

Large EPAct tax deduction become available merely by having the real estate management companies direct the lighting retrofitters and lighting specifiers involved with existing building lighting projects to install lighting and standards with watts per square foot at the better of:

1) The company’s lighting energy savings goals,

2) Local building code, and

3) The EPAct tax deduction level.

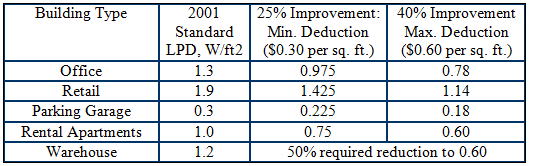

The EPAct lighting tax deduction wattage targets by the typical major space categories managed by the large real estate management companies are as follows:

HVAC

Here, the large real estate management companies should make sure they capture the HVAC EPAct tax deductions, typically available from very efficient HVAC measures including chillers, geothermal, thermal storage, energy recovery ventilation and chilled beam technologies.2, 3 Chillers are the most common HVAC technology in professionally managed buildings. The listing below presents 5 different potential chiller tax deduction opportunities.

Typical EPAct Qualifying Chiller Installations

1. High efficiency chiller included as part of overall energy efficient HVAC system

2. High efficiency Chiller installed in less than 150,000 square foot building

3. High efficiency Chiller installed in residential and hotel facilities

4. Hybrid gas driven/electric chillers that take advantage of demand charges

5. Chillers in central plant environment

To qualify for the HVAC EPAct tax deduction, a building must be modeled in IRS approved building energy simulation software. IRS has approved 13 modeling softwares and virtually all of the major HVAC vendors will model a building as part of the HVAC equipment sale process.

LEED Building EPAct Tax Deductions

LEED, which stands for Leadership in Energy and Environmental Design, is the fast growing marquee standard for sustainable buildings. LEED is the certification system established by U.S. Green Building Council (USGBC). The four certification achievements start at the LEED certified level and proceed to the higher LEED silver, gold, and platinum levels.

LEED buildings that use a meaningful number of energy efficiency measures to achieve LEED certification are excellent candidates for large EPAct tax deductions.4 The major real estate management companies are aggressively pursuing LEED status. For example recent public reports indicate that CBRE has already secured 57 million square feet of LEED certified properties.

New Building Energy Efficiency Benchmarking Rules

In many of the country’s major cities including NYC, LA, and D.C., where the major property management companies operate, have recently enacted public disclosure benchmarking rules, typically requiring buildings 50,000 square feet or greater to report their building energy use over the internet based on scheduled dates. It is those larger buildings that are typically managed by the large management companies. This disclosure is intended to inform tenants and make it obvious which properties have been managed to accomplish energy efficiency and which have not. The recommended tax planning strategy is to use EPAct tax incentives to retrofit to higher efficiency levels before the mandatory disclosure date. Presumably it will be detrimental to tenant selection and resulting property values to report an energy inferior building. Those property managers with a high portion of inferior buildings may put their management contracts at issue.5

Conclusion

The large real estate management companies are positioned to achieved major energy reduction supported by large EPAct tax deductions for their customers who are the underlying building owners, and for their underlying tenants who in reality pay the energy bills. With some easily established policy changes and standard-setting, these opportunities can be readily accomplished as part of the large real estate management companies’ ordinary course of business. New public disclosure rules are going to make it clear which buildings are energy efficient and which are not.

References

1. Goulding, Charles, Goldman, Jacob, & DiMarino, Nicole. “EPAct Tax Deductions for Lighting Gain Wider Use.” Building Operating Management. July 2008. Pg 68-74.

2. Goulding, Charles, Kumar, Raymond, & Wood, Kenneth. “New Efficient HVAC Drives Large Tax Deductions for Buildings.” Corporate Business Taxation Monthly. May 2009. Pg 11-12, 52-53.

3. Goulding, Charles, Goldman, Jacob, & Wood, Kenneth. “Tax Deductions for HVAC Efficiency.” Building Operating Management. April 2010. Pg 58-63.

4. Goulding, Charles, Goulding, Taylor, & Aboff, Amelia. “How LEED 2009 Expands EPAct Tax Savings Opportunities.” Corporate Business Taxation Monthly. September 2009. Pg 11-13.

5. Millán, Naomi. “NYC To FMs: Show Us Your Energy Use.” Building Operating Management. March 2010. Pg 23-29.