EPAct Tax Aspects of Data Centers

As humans and businesses increasingly rely on data, data centers housing rows upon rows of servers have expanded in size. Data centers are typically large square footage facilities that consume enormous amounts of electricity. For developers and operators of data centers, the strategies for locating facility sites have continued to evolve. EPAct tax savings can assist data centers operators involved in both greenfield and brownfield facility construction and energy management.

EPAct Tax Savings

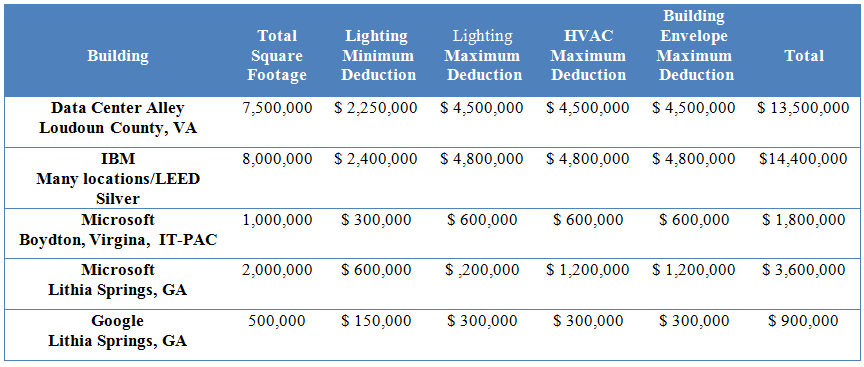

Pursuant to Code Sec. 179D, as enacted by the Energy Policy Act of 2005 (EPAct)1, properties that make qualifying energy-reducing investments in new or existing locations can obtain immediate tax deductions of up to $1.80 per square foot. If the building project does not qualify for the maximum EPAct $1.80 per square foot immediate tax deduction, there are tax deductions of up to $0.60 per square foot for each of the three major building subsystems - lighting; heating, ventilating and air conditioning (HVAC); and the building envelope. The building envelope comprises of every item on the building's exterior perimeter that touches the outside world including roof, walls, insulation, doors, windows and foundation.

Greenfield vs. Brownfield

Greenfield

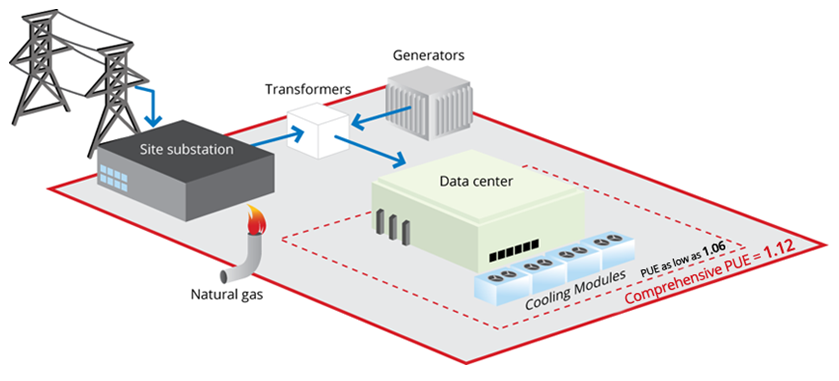

Greenfield projects are projects which are either on previously unused land or within old facilities that impose no constraints on the new project. With a greenfield development, data center owners have an opportunity to select locations with low energy costs and construct facilities tailored to data center operators. An optimal operating environment includes maximization of white space (server location areas) and spaces to place enormous amounts of servers, server cooling equipment, network wiring, power supply infrastructure, back up batteries and building mechanical equipment particularly cooling systems that support the data center operation.

Brownfield

Brownfield sites are abandoned facilities which can be re-used but first require a certain amount of cleanup or enhancement. Some brownfields have important characteristics that are valuable to data centers, including a low purchase price (particularly for large, vacant industrial buildings), large square footage, and sufficient ceiling heights to install the lattice work of below-floor network and power lines necessary to operate a data center. The following chart illustrates the type of energy efficient lighting, HVAC, and building envelope equipment applicable to data centers.

Data Center Energy Tax Planning2

Data Center locations

Data center operators must give careful consideration to the geographical locations of data centers. After 9/11, New York City data center operators moved portions or all of their data centers to offsite locations in New Jersey. After extensive regional building damage impacting both New York City and New Jersey related to Hurricane Sandy, many of these same companies are further diversifying their data centers to other regions throughout the country.

Google’s Best Practices

The industry standard energy performance parameter for data centers is the Power Usage Effectiveness (PUE). This measurement is the ratio of total facility energy usage, including climate control and all other overhead, to the energy consumption by IT computing equipment. According to the Uptime Institute’s 2012 Data Center Survey3, the average PUE for large data centers was approximately 1.8, compared to Google’s average of 1.12. This significant difference is primarily due to Google’s innovative energy engineering practices. For example, Google recently began to utilize thermal modeling of their server racks to optimize airflow. Also, they have incorporated many unique HVAC processes including evaporative cooling of server exhaust and the use of free cooling methods involving ambient air and even seawater. These improvements not only save millions of dollars in energy cost consumption yearly, but also increase the opportunity for larger EPAct tax deductions when compared to an ASHRAE 90.1 2001 reference building4,5.

Figure 1: Google’s Power Usage Effectiveness (PUE) measurements and optimization.6

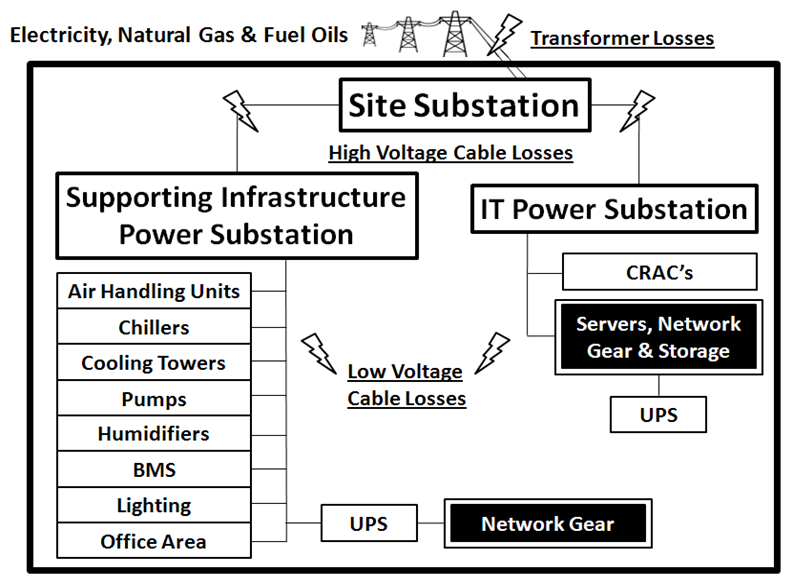

The figure below presents the lighting and HVAC components of a data center.

Figure 2: Major data center energy components and losses.

The chart below illustrates the potential EPAct tax deductions related to select data centers.

Figure 3: Potential EPAct Tax Deductions Available for Data Centers

The Need for More Corporate and University Data Storage

There is an increased recognition in the corporate and university research and science community that there is not enough data storage available for the increasingly large amounts of scientific data. Google initially promised free hosting of large data sets for scientists and then terminated the program after one year without comment. Speculation is that Google was shocked by the amount of storage required. For example, the Obama administration’s proposal to capture the activity of just one million neurons in the human brain would require three petabyes of information. However when one realizes that the human brain7 has about 85 to 100 billion neurons the scope of the challenge becomes much more evident.8

Conclusion

With the massive need for increases in servers, the data center facility industry is expected to experience high growth rates. Greenfield and Brownfield data center operations should be able to increasingly use EPAct tax incentives as they reduce building energy use.

1 - Energy Policy Act of 2005 (P.L. 109-58).

2 - “The Tax Aspects of Cloud Computing & Data Centers”, Charles Goulding, Jacob Goldman, and Cassandra Gengler, Corporate Business Taxation Monthly, December 2010, at 9.

3 - Available online at http://uptimeinstitute.com/2012-survey-results

4 - "Google Throws Open Doors to Its Top-Secret Data Center." Steven Levy. Accessed at http://www.wired.com/wiredenterprise/2012/10/ff-inside-google-data-center/all/

5 - “The EPAct Tax Aspects of Lady MAGA”, Charles Goulding, Jennifer Pariante, & Spencer Marr, Corporate Business Taxation Monthly, April 2012, at 19.

6 - Available online at http://www.google.com/about/datacenters/efficiency/internal/

7 - “The R&D Tax Credit Aspects of Cognitive Computing”, Charles R. Goulding, Andressa Bonafe, and Charles G. Goulding, To be published in Corporate Business Taxation Monthly.

8 - “Connecting the Neural Dots”, John Markoff, The New York Times, February 25, 2013. Accessed at: http://www.nytimes.com/2013/02/26/science/proposed-brain-mapping-project-faces-significant-hurdles.html?pagewanted=all&_r=0