The Energy Tax Aspects of Warehouse and Distribution Centers

Virtually every warehouse in the United States that hasn't recently retrofitted its lighting has the opportunity to effectuate substantial energy cost savings while simultaneously obtaining a large tax deduction. Tax savings are also available for other warehouse energy-reducing investments, such as building envelope and heating and cooling systems. Warehouses, sometimes called distribution centers, are an integral part of the American economy, and for the remainder of this article we will interchangeably use the term distribution center to also mean warehouse.

Large numbers of distribution centers are owned by logistics companies, warehouse developers and national and regional retailers. The large warehouse owners strategically locate their warehouses at major transportation hubs such as airports, seaports and rail terminals. Manufacturers often have warehouses at their manufacturing location and those facilities may be contiguous (meaning attached to the manufacturing facility) or located in a nearby building.

From an energy management standpoint, warehouses are generally categorized as unconditioned, meaning no HVAC (heating, ventilation and air conditioning) or conditioned, meaning the facility does have HVAC. Conditioned warehouses may have cooling capability, indicating refrigeration or freezer equipment. From a building energy perspective, the distinction between unconditioned and conditioned is crucial, as conditioned buildings are required by building code to have more energy- efficient building envelopes (including roofs) and higher levels of insulation. Large square footage, high turnover supporting distribution centers in the southern part of the United States often have a large staff of employees engaged in pick-and-pack work activities and by necessity must be air conditioned .

The EPAct Tax Opportunity

Pursuant to Energy Policy Act (EPAct) Section 179D, warehouse owners or tenants making qualifying energy-reducing investments can obtain immediate tax deductions of up to $1.80 per square foot.

If the building project doesn't qualify for the maximum $1.80 per square foot immediate tax deduction, there are tax deductions of up to 60 cents per square foot for each of the three major building subsystems: lighting, HVAC and the building envelope. The building envelope is every item on the building’s exterior perimeter that touches the outside world including roof, walls, insulation, doors, windows and foundation

Unconditioned Warehouses

With unconditioned warehouses, building lighting comprises the primary building energy use. Most warehouses that have not had a lighting upgrade to energy efficient lighting in the last 7 or 8 years utilize prior generation metal halide or T-12 fluorescent lighting. It is also important to realize that effective January 1, 2009 most probe-start metal halide lighting may no longer be manufactured or imported into the United States and effective July 1, 2010, most T-12 lighting may no longer be manufactured or imported into the United States. This means that warehouses that still have this lighting technology will soon be subject to large price increases for replacement lamps and bulbs.

This prior generation T12 and metal halide lighting is very energy inefficient compared to today's T-8 and T-5 lighting, and a lighting retrofit can easily reduce lighting electricity costs by 40 to 60 percent. In addition to large energy cost reduction from the base building lighting, most warehouses undergoing lighting retrofits install sensors that completely shut off the lighting in portions of the warehouse that are not in use. Previously, many warehouse owners and lighting specifiers were reluctant to install sensors because they reduced fluorescent lamp useful life. Today, improved technology sensors are available with warrantees not to reduce lamp useful life.

Conditioned Warehouses

With conditioned warehouses, energy management includes the lighting cost reduction opportunities described above plus the ability to obtain substantial energy cost reduction through building envelope and HVAC improvements. Energy managers who are building new construction or retrofitting existing conditioned warehouses should strongly consider engaging tax and engineering firms with computer energy simulation modeling capability. With an IRS-approved model, the engineering firm can help the warehouse owner optimize the utilization of energy efficient equipment to reduce energy operating costs and maximize EPAct tax deductions and utility rebates, particularly in jurisdictions that provide utility rebates for highly energy efficient HVAC, roofs, insulation, refrigeration and freezer equipment.

For example, a 500,000 square foot warehouse could use this approach to make the needed investments that trigger a $900,000 immediate EPAct tax deduction (500,000 square feet x $1.80) which would provide a first year tax contribution of $360,000 towards the cost of the energy efficiency improvements using a 40% combined Federal and state rate.

EPAct Warehouse Tax Planning

Since the EPAct tax deduction opportunity with large warehouse is so great, it is important to understand some of the major warehouse tax planning opportunities. We have seen many warehouse owners conclude that they were not eligible for tax savings when they are in fact eligible.

The Space Utilization Opportunity

Some so-called warehouses often have meaningful subspaces that are devoted to non-warehouse activities. Typical non-warehouse activities include manufacturing, assembly, processing including food processing, repairs including furniture repair, workshop areas and other non-pick-and-pack areas. By documenting the non-warehouse activity square footage, warehouse owners can more easily plan into higher levels of tax deduction since the pure warehouse space category is subject to higher performance standards for tax purposes, particularly in the lighting area.

The Space Characterization Issue

The IRS Sec. 179D (Energy Policy Act tax benefits are based on the ASHRAE (American Society of Heating Ventilation and Air Conditioning Engineers) definition of buildings. Often businesspeople will refer to a building as a warehouse or a distribution center when from an ASHRAE perspective it is not a warehouse. The proper way to characterize a building is by the most significant activity occurring in the facility. As a general rule, any other building category but warehouse is a better category for Section 179D tax deduction purposes. For example, postal distribution facilities and mail sorting facilities have their own more favorable building wattage categories. Any facility where the most significant activity is one of the non-warehouse activities described immediately above will more easily qualify for an EPAct tax deduction.

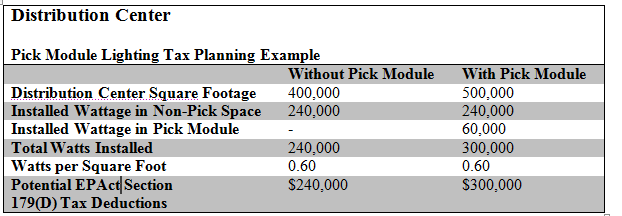

Warehouse Mezzanines and Distribution Center Picking Modules

Many distribution centers have mezzanine levels or multi story/floor level picking module building subsystems that also have ceiling lighting. Since every roof level is considered a space for ASHRAE purposes, those spaces can be included or excluded in EPAct calculations. Only spaces subject to a project can be considered in an EPAct project. So for example, if the distribution center lighting is retrofitted but the lighting in the picking module is not upgraded, only the non-picking module distribution center space can be counted in the EPAct square footage calculation. However, if the picking module lighting is retrofitted, the additive square footage of each ceiling level with lighting can be counted thereby resulting in a larger tax deduction.

Additional Tax Deductions for New Warehouses

Skylighting allows for the sun to light the warehouse space during daylight hours. Combined with a lighting system utilizing photosensors, the lighting system can be automatically shut down when the sun light produces light levels in the warehouse that reach a prescribed level. These combined systems are termed Daylight Harvesting Systems. These systems can turn off the lights in the warehouse, in some cases, over 10 hours in a day. In a 18 hour/day operation this can cut the energy used by the lighting by more than half.

The combination of skylights and the added insulating efficiencies achieved in new warehouses have allowed for Section 179D tax deductions of greater than $0.60/sq.ft.. $1.20/sq.ft. is available and in some cases up to $1.80/sq.ft..

Solar P.V.

Solar P.V. rooftop systems are used to generate electricity at warehouses. Warehouses typically make ideal solar installation candidates since they often have large, flat roofs. Large roofs enable large systems that generate more electricity. Solar P.V. installations are entitled to 30% tax credit or now for the first time a 30% grant¹. When using either the credit or the grant, five years MACRS deprecation is available. Often tax equity partners will be willing to make the investment for a rooftop warehouse solar installation and enter into a power purchase agreement where the warehouse operator post-installation will purchase its electricity at an agreed price for a fixed period of time, usually 15 to 20 years. The tax equity partner will use a combination of the power purchase agreement annual revenue, the tax credit or grant, utility rebates if available, green tag emission payments and net metering electricity payments for selling the excess power back to the grid to generate an acceptable economic return.

Conclusion

Warehouse owners and tenants have tremendous opportunities to save energy costs utilizing EPAct and alternative energy tax provisions to further improve the economic return from their investments. In the current economic environment, warehouse owners need to provide energy efficient facilities to attract tenants, and tenants need to reduce energy operating costs to remain competitive

References

¹ See Charles Goulding, Jacob Goldman and Taylor Goulding, Tax Planning for the 21st Solar Century, Corp. Bus. Tax’n Monthly, February 2009, at 23.