EPAct 179D Tax Aspects of Induction Lighting

Although the most frequently discussed categories of commercial lighting are fluorescent and LED's (Light Emitting Diodes) over the past decade, one increasingly popular lighting alternative is induction lighting. Induction lighting is actually fluorescent lighting, but without electrodes and is sometimes called ‘electrodeless discharge lighting.’

The EPAct Tax Opportunity

Pursuant to Energy Policy Act (EPAct) Section 179D, building owners or tenants making qualifying energy-reducing investments can obtain immediate tax deductions of up to $1.80 per square foot.

If the building project doesn't qualify for the maximum $1.80 per square foot immediate tax deduction, there are tax deductions of up to 60 cents per square foot for each of the three major building subsystems: lighting, HVAC (heating, ventilating, and air conditioning), and the building envelope. The building envelope is every item on the building’s exterior perimeter that touches the outside world including roof, walls, insulation, doors, windows and foundation.1

Growth of Induction Lighting Market

The recent marked increase in induction lighting installations in the United States is an intriguing development since the merits of this lighting technology have been long recognized in Europe. The fact that two of the worlds largest lighting companies with an expanding U.S. market presence (namely Philips of the Netherlands and Siemens) are both European companies with long term involvement with induction technology probably has a lot to do with the growth in the U.S. induction lighting market. Before the introduction of LED building lighting with its high unit prices and long useful life the almost universal energy efficient lighting selection by U.S. commercial property owners was mainstream fluorescent lighting. Since LED building lighting is new, unproven and expensive, property owners and design consultants have by necessity been obligated to engage in more thoughtful product evaluation analysis. We believe it is this more thoughtful analysis by sophisticated purchasers proceeding with caution that has resulted in a better understanding of the benefits of induction lighting technology as an alternative technology with a demonstrated history of meeting many of the added benefits promised by LED technology.2

Induction Lighting Technology

Since all of the major alternative lighting solutions have positive and negative attributes, it is particularly important to work with lighting professionals familiar with all technologies and the type of facility undergoing a lighting project.

It terms of major positive attributes, induction lighting has the advantage of long life rated at 100,000 hours, and also a much lower price point than LEDs. LED building application's are relatively new applications and are currently very expensive. The very long induction lighting product life makes this a good solution for saving maintenance costs in difficult to reach lamp replacement areas. Induction lighting also has good performance characteristics in cold environments.

Some negative attributes are price points higher than fluorescent lighting, and often utility rebate programs do not specifically address this highly energy efficient technology. Where a utility provides for lighting rebates but doesn't specifically provide for prescriptive (set or prescribed amount per lighting fixture) induction lighting rebates, the building owner should inquire about custom rebates or ask for at least the same rebate being offered per fixture for LED lighting..

For tax purposes, it is very important to realize that induction lighting uses very low wattages and normally qualifies for the highest level of the Section 179D tax deduction. Moreover, the low wattage level and overall energy savings often enables facilities to qualify for multiple EPAct tax deductions, particularly when coupled with Cambridge3 heater installations and other highly energy efficient HVAC solutions in warehouses and industrial spaces.

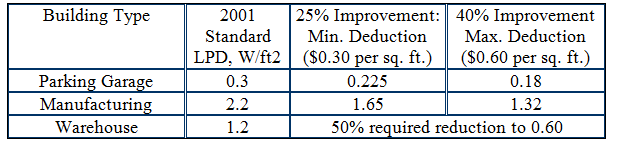

The EPAct lighting tax deduction wattage targets by the typical major space categories that can utilize induction lighting use:

Leading Induction Lighting Expert’s Comments

Robin Conway, a leading expert on induction lighting and President of C-Light LLC, noted the renewed interest on induction lighting:

"Induction Lighting technology has been around since the late 80's, however there has been a renewed consumer interest since its’ attributes parallel that of LEDs. LED lighting is here to stay, nevertheless, there seems to be two groups of consumers: those who insist on the latest and greatest in lighting, such as LEDs, and those who want to wait it out just a little bit longer prior to making such a substantial investment.

Induction Lighting is perfect for the LED skeptic. Induction provides a cost effective lighting upgrade, and it is a tried and true energy solution. Most Induction lighting upgrades can realize a return on investment in less than 2 years, and are perfect for large projects such as parking decks and warehouses. The upgrade is simple: a one-for-one HID(High Intensity Discharge) to induction replacement. This retrofit delivers an energy savings of up to 60% and reduces maintenance costs up to 75%. On top of these investment and operational cost savings, most of these projects qualify for a tax deduction using the Energy Policy Act of 2005."

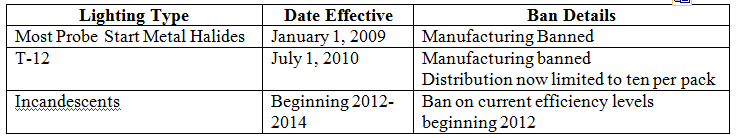

Understanding the Federal Lighting Bans

Forward-looking companies should consider induction lighting as an alternative to several traditional lighting options that are beginning to be phased out due to their inefficiency. The chart below provides detail on the bans that will be going into effect.3

T-12's are one of the most widely utilized lamps and can be found in many existing buildings, merchandise display cases, and numerous other applications. Pursuant to the Energy Policy Act of 2005, ballast manufacturers cannot manufacture T-12 magnetic ballasts after July 1, 2010. T-12 lamps are very high energy users compared to today's lighting products. The number in a fluorescent lamp description describes the number of eights of inches in the lamps diameter. Hence a T-12 lamp is an inch and one half and T-8 is an inch in diameter. Companies with large purchases of T-12 replacement lamps should begin to expect price increase for future replacements. It wasn't until 2005 that the number of T-8's sold exceeded T-12's which demonstrates that there are still a tremendous number of existing T-12 lamps destined for replacement.

The second main stay commercial lighting product that was made illegal to manufacture as of January 1, 2009 is a standard probe start metal halide fixture. Pursuant to the Energy Independence and Security Act of 2007 a metal halide lamp fixture with lamps greater than or equal to 150 watts but less than 500 watts contain must either be:

1. a pulse start metal halide ballast with a minimum ballast efficiency of 88 percent,

2. a magnetic-start ballast with a minimum ballast efficiency of 94 percent,

3. a non-pulse state electronic ballast with

A. a minimum ballast efficiency of 92 percent for wattages greater than 250 watts

B. a minimum ballast efficiency of 90 percent for wattages of 250 watts or less.

There are some exceptions to these rules for some specialized fixtures.

Conclusion

Tax departments with properties undergoing interior building induction lighting upgrades should realize that these applications generally support large Section 179D lighting tax deductions. In particular, when this lighting is installed in heat-only non air-conditioned facilities such as warehouses, industrial buildings, auto repair facilities and sports complexes, multiple Section 179 (D) EPAct tax deductions may be achievable.

References

1. Goulding, Charles, Goldman, Jacob, & DiMarino, Nicole. “EPAct Tax Deductions for Lighting Gain Wider Use.” Building Operating Management. July 2008. Pg 68-74.

2. Goulding, Charles, Goldman, Jacob, & Goulding, Taylor. “The Economic, Business and Tax Aspects of Light Emitting Diode Interior Building Lighting.” Building Operating Management. January 2009. Pg 31-32.

3. Goulding, Charles, Goldman, Jacob, & Kumar, Raymond. “Large EPAct Energy Tax Deduction Opportunities for Commercial Heaters” Corporate Business Taxation Monthly, January 2010, Pg. 11-12, 28-29