Energy and Tax Savings Opportunities for Self-storage Facilities

The U.S. self storage facility industry has experienced tremendous growth in recent years. These typically large facilities are often found on the perimeter of most major cities where residents need extra storage space. Current total U.S. square footage of self storage facilities is estimated at 2.35 billion square feet with the average facility size approaching 50,000 square feet. Due to their large size, unique space configuration and recent technology changes, storage facilities have the opportunity to generate substantial Section 179D Energy Policy Act (EPAct) tax savings.

The EPAct Tax Opportunity

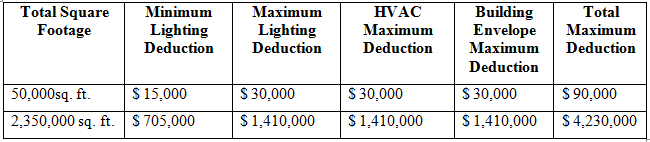

Pursuant to Energy Policy Act (EPAct) Section 179D, building owners or tenants making qualifying energy-reducing investments can obtain immediate tax deductions of up to $1.80 per square foot.

If the building project doesn't qualify for the maximum $1.80 per square foot immediate tax deduction, there are tax deductions of up to 60 cents per square foot for each of the three major building subsystems: lighting, HVAC (heating, ventilating, and air conditioning), and the building envelope. The building envelope is every item on the building’s exterior perimeter that touches the outside world including roof, walls, insulation, doors, windows and foundation .

The following table illustrates the potential EPAct tax savings available to the industry at and for an average size 50,000 square foot facility:

Space Configuration and Lighting Opportunities

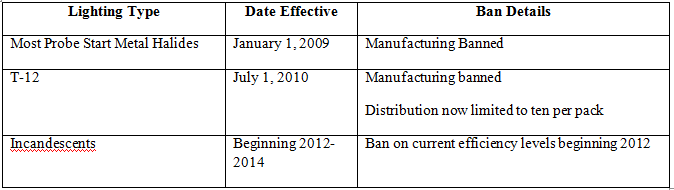

The self storage industry focuses on specific storage customer niches including individuals, small businesses and large businesses. Rooms for individuals and small businesses are often small spaces that previously utilized incandescent lighting. Since incandescent lighting will shortly be subject to Federal lighting bans (see federal lighting ban table below), all self storage facilities should be upgrading to highly energy efficient low wattage compact fluorescent lighting or LED (Light Emitting Diode) lighting .

Previously, large rooms in self storage facilities used either probe start metal halide or T-12 lighting. This lighting is also subject to federal legislative ban which is described in the table below. It is crucial for storage facilities to use occupancy sensors or lighting control, systems since the room lights can be completely shut off for extended periods of time.

Climate Control Opportunities

An increasing number of storage facilities are climate controlled since customers prefer facilities where it is more likely that their property and possessions will remain in good condition. Having a climate control option is a particularly important customer attraction element since a mature self storage market has become more competitive. To maintain stored property properly, it is necessary to control temperature, humidity and dust. Storage facilities are often ideal candidates for highly energy efficient energy recovery ventilation equipment (commonly called ERV), that optimizes the use of outside air. HVAC systems designers who are familiar with storage centers can utilize high efficiency equipment and create a design configuration that optimizes the building spaces. For example, it is not necessary to have a separate HVAC unit in every space. HVAC design configurations that use less HVAC equipment to cover more rooms are much more likely to qualify for the EPAct HVAC tax deduction.

Dehumidification Systems

One of the leading technologies for reducing self storage center energy costs while controlling temperatures and humidity are desiccant wheel dehumidification systems. It is particularly important to manage temperature and humidity when storing computer equipment, musical instruments, antiques, furniture, electronics, pictures books, and legal and medical records. One of the most popular systems is made by Munters Corporation. The Munters web site provides extensive information about this technology .

Natural Gas Heaters

Self storage facilities in the northern portion of the United States often use energy efficient natural gas heaters to meet their climate needs. The increased abundance of low cost natural gas in the United States is making these heaters a very popular product choice. Large tax deductions are available for these heaters, provided that the storage facility upgrades to energy efficient lighting either before or currently with the heater purchase .

Building Envelope EPAct Tax Opportunities

Storage centers often arise from the conversion of existing previous manufacturing, warehouse or car dealer facilities. When this type of building conversion occurs, it is generally necessary to open the building envelope to insert access doors, overhead doors and make other necessary storage center building envelope changes.

Once the envelope is open, it is the most cost effective time to install insulation and reskin (recover) the building envelope. Since the building envelope doesn't physically utilize energy, the ability to achieve a building envelope tax deduction is dependent on previous or concurrent investments in energy efficient lighting and HVAC lighting. The following example illustrates the concept:

Presume a 200,000 square foot self storage facility invests $160,000 in energy efficient lighting and heater that results in a 50% energy cost reduction compared to ASHRAE 2001 standards. Although the building qualifies for a $360,000 EPAct tax deduction (200,000 sq.ft.* $1.80 per square foot), the initial EPAct tax deduction is limited to the $160,000 project cost. However, the remaining 200,000 of potentially available EPAct tax deduction can be used for building envelope improvements, such as new roof or insulation.

Thornwood Energy Efficient Storage Center Example

A recent building conversion illustrating all of the above described energy efficiency measures is the 2009 Thornwood, NY conversion of a health club into a self storage facility. The Thornwood self storage center utilizes climate controlled units equipped with a motion-sensor lighting system. The facility also uses solar power as a means to further reduce its energy costs .

Tax Planning Summary

The key to optimizing and generating multiple self storage center EPAct tax deductions is to simultaneously install very energy efficient lighting with the other energy efficiency measures, particularly HVAC. The lighting upgrade is normally required since lighting is often the largest energy user in storage facilities, and the EPAct modeling tax system is based on total building energy cost reduction. For example, installing energy efficient HVAC, such as dehumidification systems or natural gas heaters alone, may not enable a self storage facility to qualify for the HVAC EPAct tax deduction. However, installing energy efficient lighting with sensors, along with the upgrade to highly energy efficient HVAC, makes it much more likely that the HVAC will qualify for EPAct tax deduction. Once the facility is upgraded with energy efficient lighting and energy efficient HVAC, it is much more probable that the building envelope also will be become eligible for immediate EPAct tax deduction.

New Building Benchmarking Rules

Some of the largest markets for self storage centers including Austin, TX, Los Angeles, CA, New York, NY, Seattle, WA and Washington, D.C., have recently enacted new mandatory public disclosure building energy usage benchmarking rules. With the New York City law, all commercial buildings above 50,000 square feet must disclose their energy use. Environmentally conscious urban customers will have access to this data and may factor the differences in operating cost and sustainability into their storage center choice decision.

Conclusion

With American lifestyle changes, self storage facilities have become a major building category in the United States. Federal product law changes impacting existing technologies, and new energy efficient retrofit products coupled with market competition, provide a great opportunity to save energy costs and utilize Section 179D EPAct tax incentives.