Frictionless Chillers: Generating EPAct Tax Benefits for All Building Sizes

Intro

Throughout the seven years that EPAct has been in effect, chillers have proven to be a fertile technology to provide EPAct tax benefits.1 When either compared to package units in buildings over 150,000 sq.ft. or combined with other energy saving technologies such as DCV or ERV, chillers routinely qualify a building for up to $1.80/sq.ft. in EPAct tax deductions. However, developments in chiller technologies which vastly improve the operating efficiencies are revolutionizing the ways in which buildings are qualifying for EPAct.

Code Sec. 179D Tax Opportunities

Pursuant to Energy Policy Act (EPAct) Code Sec. 179D,2 as enacted by EPAct, commercial property owners making qualifying energy-reducing investments in their new or existing locations can obtain immediate tax deductions of up to $1.80 per square foot.

If the building project does not qualify for the maximum $1.80-per-square-foot immediate tax deduction, there are tax deductions of up to $0.60 per square foot for each of the three major building subsystems: lighting, HVAC (heating, ventilating, and air conditioning) and the building envelope (everything on the perimeter of a building that “touches” the outside world). For projects completed since March 2012, an energy reduction cost of only 15% over the standard needs to be shown to qualify for the $0.60 per square foot HVAC benefit, and 25% to qualify for the $1.20 per square foot HVAC and envelope benefit.

Frictionless Chiller Operation

A traditional centrifugal chiller employs a system of bearings around a shaft in its compressor. These bearings create a small amount of friction when moving against the shaft while in operation. By swapping these traditional bearings for magnetic bearings, which do not come into contact with the shaft, the friction saved turns into tremendous energy savings. These Magnetic Bearing Chillers, or Frictionless Chillers, have demonstrated high energy savings over traditional chiller models, and are qualifying buildings for EPAct tax benefits.3

Although frictionless chillers have been available since 2004, only recently has there been a widespread implementation of the technology in new building and retrofits. Many companies now offer a chiller model that incorporate frictionless compressors. Some of the most frequently installed systems are from Mcquay, Mammoth, Multistack and York.

Efficiency Comparisons to Traditional Models

Frictionless chillers have shown efficiencies of up to 40% when compared to traditional chillers. This number raises to 50-60% when compared to traditional rooftop package units.4 Since these comparisons are so significant, it redefines the way buildings with chillers can qualify for EPAct. Normally, a traditional chiller can only perform favorably against EPAct when it is in a building less than 150,000 sq.ft. or combined with a combination of DCV, ERV or VFDs. The high efficiencies of frictionless chillers mean that, for all building sizes the installation of only a frictionless chiller can be enough to trigger EPAct benefits.

VFD

Most frictionless chillers come standard equipped with Variable Frequency Drives (VFDs). VFDs provide additional energy savings to an HVAC system due to their ability to change the operating speed of the pumps and fans based on the actual needs of the serviced spaces. Normally, VFDs are efficient enough that buildings with VFDs servicing all areas qualify for some level of EPAct tax deductions. When these are combined with already highly energy-saving frictionless chillers, it creates an EPAct superpower.

Project Samples/Potential of Buildings

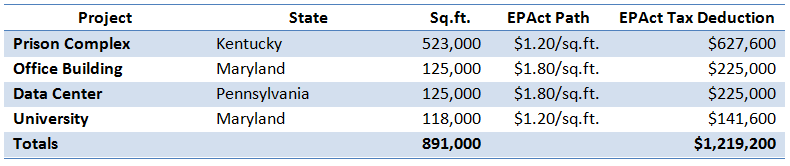

Frictionless chillers have proven to be effective at securing EPAct benefits. When combined with energy efficient lighting these projects frequently qualify for the $1.20/sq.ft. or maximum $1.80/sq.ft. EPAct tax benefit. A selection of buildings that have installed magnetic bearing chillers and the EPAct benefits for which they qualified can be found below:

Table 1: EPAct Benefits for Buildings with Frictionless Chillers

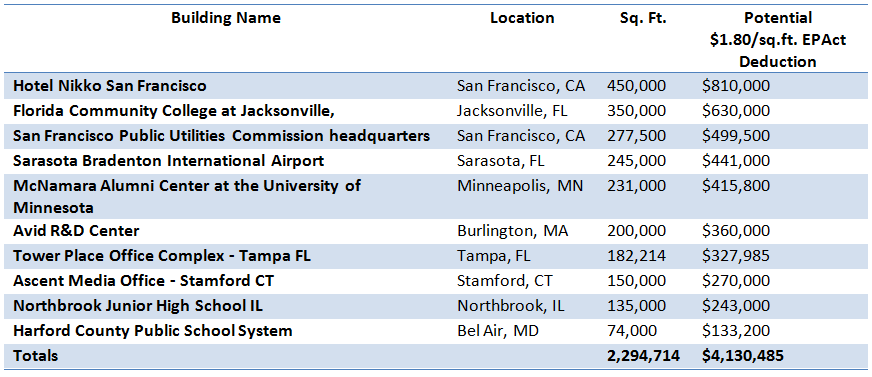

The number of buildings that have installed frictionless chillers to date is rapidly growing. There is likely a high number of buildings equipped with frictionless chillers that have not taken advantage of any EPAct tax incentives. Below is a sampling of some of the other buildings that have incorporated frictionless chillers and their potential EPAct benefits:

Table 2: Potential EPAct Benefits for Buildings with Frictionless Chillers

Conclusion

Due to the high efficiency and convenience of frictionless chillers, more and more buildings are opting to install these as part of measures to save energy. The energy cost savings from these chillers almost always trigger EPAct tax deductions of up to $1.80/sq.ft. in all building types and sizes, which help commercial property owners pay for the initial cost of the energy upgrade.

1 - Goulding, Charles R., Charles G. Goulding, and Jacob Goldman. "Corporate Business Taxation Monthly." Corporate Business Taxation Monthly. (September 2012): 12-17. Print.

2 - Energy Policy Act of 2005 (P.L. 109-58) (“EPAct”).

3 - http://www.daikinmcquay.com/Magnitude

4- See press release: http://energy.gov/articles/department-energy-announces-first-entry-market-driven-high-efficiency-commercial-air