EPAct 179D Tax Savings for the NBA

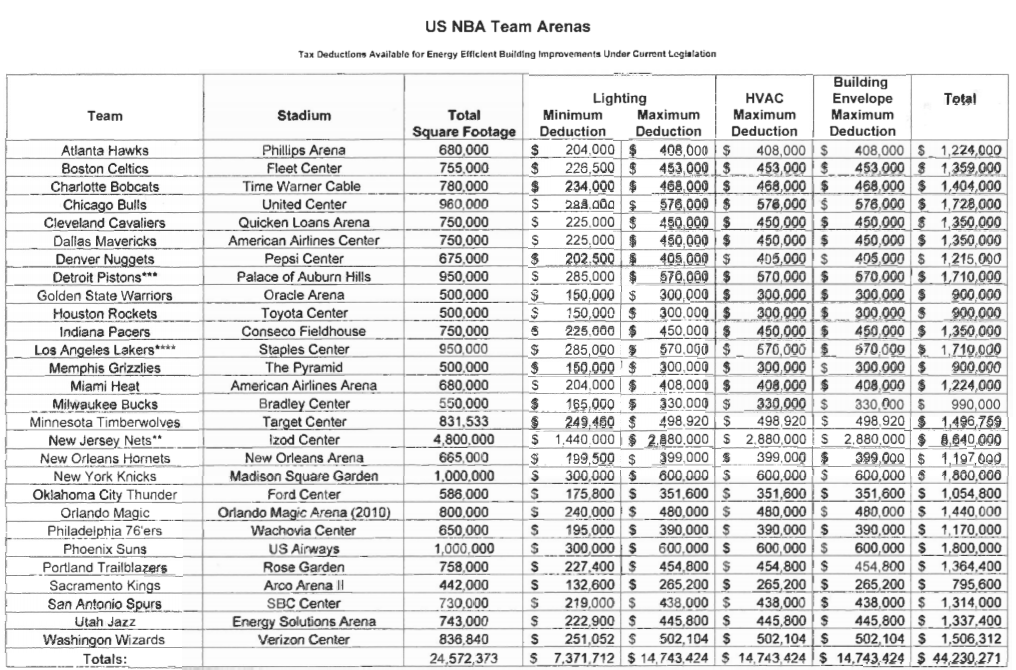

The National Basketball Association (NBA) has entered into a partnership with the Natural Resources Defense Council (NRDC) aimed at having the NBA “reduce its ecological impact and to help educate basketball fans worldwide about environmental protection”. NBA arenas owned by both private commercial enterprises and designers involved in government owned arenas can use a variety of tax incentives to accomplish these goals. NBA basketball arenas are big structures that have the potential to utilize large Section 179(D) Energy Policy Act (EPAct) tax deductions to help achieve their targeted energy efficiency goals. Section 179 (D) provides for 60 cent per square foot tax deductions each for lighting, HVAC (heating, ventilation and air-conditioning) and for the building envelope. The following table presents the potential EPAct Section 179 (D) energy efficiency tax deduction benefits for 28 of the NBA's current U.S. arenas.

See chart below

The typical types of energy reducing investments for NBA arenas that will qualify for the three categories of Section 179(D) tax benefits (described in the above table) are presented below:

Energy Efficient Lighting

NBA's arenas use a lot of electricity for interior building lighting. Today's building lighting products, on average, use 40 to 60 percent less electricity then those lighting products of only 5 or 6 years ago. The maximum 60 cent per square foot lighting tax deduction is calculated on a room by room basis, which means the main seating and event area can generate the largest lighting tax incentive. Specific types of stage and task lighting can be excluded from the energy efficiency tax calculation making the strictly building related energy efficient lighting incentive easier to obtain.

NBA stadiums are often supported by large parking garages that can use EPAct tax savings to upgrade to energy lighting. Many of the parking garages adjacent to NBA arenas often utilize prior generation probe start metal halide lighting that is energy inefficient, and as of January 1, 2009, is illegal to manufacture or import into the United States. To obtain the 30 to 60 cent per square foot tax deductions for parking garages, the watts per square foot have to meet prescribed targets .

Energy Efficient HVAC (Heating, Ventilation and Air Conditioning)

One of the largest energy users in NBA arenas is HVAC. Arenas can use highly energy efficient special purpose HVAC solutions, such as energy recovery ventilation, geothermal and thermal storage, to greatly reduce energy usage and potentially qualify for a large EPAct HVAC tax deduction.

Many of the NBA arenas are within city centers where electricity in particular is supply constrained. A material reduction in energy use in these facilities will greatly benefit the communities that support professional basketball. One HVAC technology that can greatly reduce arena peak time electrical energy use is thermal storage. With thermal storage systems, ice is manufactured at night when electricity is in excess supply and electricity prices are very low. This inexpensive energy is then used to cool the building down during the day when electricity is in peak demand and is very expensive. The one million square foot Wachovia Facility hosts nearly 300 events a year, including games for the NHL's Philadelphia Flyers and the NBA's Philadelphia 76ers. Michael Ahearn, Vice President of operations for the Wachovia center in Philadelphia, expressed the benefits of their thermal storage system this way: "It’s a system that works for everyone…It helps reduce our expenses and saves energy for the rest of the community. " NBA arenas that invest in thermal storage will generally qualify for the $1.80 per square foot tax deduction presented above and those that already have thermal storage should be positioned to obtain the $1.80 per square foot tax deduction when making further arena facility energy reducing investments.

Energy Efficient Building Envelope

Unlike lighting and HVAC, the building envelope does not actually consume energy so the 60 cent per square foot Section 179(D) arena building envelope energy tax deductions will be predicated by achieving energy efficient lighting and, in particular, HVAC energy efficiency targets.

Qualifying building envelope items for tax deduction include roofs, walls, doors, windows, foundation and insulation.

Accordingly, those arenas that have or are proposing to have highly energy efficient measures such as thermal storage or geothermal, will be positioned to simultaneously achieve large tax deductions for investments made in qualifying building envelope items.

Understanding Energy Modeling

To obtain the HVAC and building envelope tax deduction, the arena must be modeling in IRS approved modeling software. Section 179(D) lighting tax incentives do not require modeling. New LEED (Leadership in Energy and Environmental Design) arenas must be modeled to qualify for LEED. LEED certification is increasingly being required to be accomplished for most new government owned or government funded arenas. The American Airlines arena is the first NBA arena to achieve the coveted LEED certification status. According to the April 29th, 2009 press release the arena's energy efficient features include a cool roof and an offsite chiller . Some state and utility rebate incentives require modeling, particularly for large energy reducing projects. All arena's that have or are contemplating thermal storage, geothermal or energy recovery ventilation should strongly consider having their building modeled to evaluate there building’s performance and then secure their probable Section 179(D) tax deductions. Many state and utility rebate programs will pay all or a portion of modeling costs pursuant to proposals to make new energy efficiency investments.

Alternative Energy

Most mainstream alternative energy investments including solar, wind and geothermal are now eligible for federal tax credits or economically equivalent grants and five year deprecation. When made within bonus deprecation eligibility time periods, some of these investments may also be eligible for 50% bonus deprecation. Two examples of NBA arenas that have recently made solar investments are as follows:

(1)U.S. Airways Center: Installed 1,125 panels and 18,000 square feet of solar photovoltaic (PV) panels to produce 331,233 kilowatts of electricity per year

(2)Staples Center: Installed 1,727 panels and 24,190 square feet of solar PV panels. In a combined project whereby the Nokia Theater, LA (located directly across the street) also installed PV. The combined systems will generate 512 kilowatts of electricity per year .

Conclusion

The NBA Green initiative presents tremendous opportunity for energy and tax savings for both commercial owners and designers involved with government owned arenas. For the last 12 years the NBA has made large capital investments in automated computer and software systems to measure player performance statistics. NBA Executive Vice President of Operations and Technology, Stephen Hellmuth said, “You’re not in a league unless you got a statistics system. ” Presuming NBA Commissioner David J. Stern takes the same approach in monitoring and measuring arena energy performance while identifying the related tax opportunities, the NBA can be of great service in helping lead the nation into an energy efficient future.

The NBA and the NRDC are hoping that the NBA green initiative will serve as a model and catalyst for other facility’s green initiatives. Reducing arena energy uses will serve as a direct model for the myriad of other inner city athletic facilities including K-12 school athletic facilities and community college and university athletic facilities. Indirectly, the NBA green initiatives will influence many parties since NBA actives are widely followed and emulated.

References

"NBA.com: NBA, NRDC team up for first-ever NBA Green Week." NBA.COM - The Game Happens Here. 01 Apr. 2009. 07 July 2009 <http://www.nba.com/2009/news/04/01/green.week.release/>.

Goulding, Charles & Kelly, Peter & Goulding, Taylor. “EPAct Tax Deductions for Parking Garage Lighting Projects Gain Wider Use.” The Parking Professional. September 2008.

Pedone, Kelly. "Environmentally Friendly." IAAM. International Association of Assembly Managers. 07 July 2009 <http://www.iaam.org/facility_manager/Pages/2006_Dec_Jan/Feature_2.htm>.

Brinkmann, Paul. "American Airlines Arena gets LEED certification - South Florida Business Journal:." South Florida Business Journal: Local Business News |. 07 Apr. 2009. 07 July 2009 <http://southflorida.bizjournals.com/southflorida/stories/2009/04/06/daily23.html>.

Clark, Emily. "US Airways Center announces solar installation." Gizmag Emerging Technology Magazine. 07 Sept. 2008. 07 July 2009 <http://www.gizmag.com/us-airways-center-announces-solar-installation/9956/>.

"Solar Powers Staples Center Events, Green Cuisine Factory | NBC Chicago." Chicago - Local News, Weather, Traffic, Entertainment, Events, Breaking News | NBC Chicago. 29 Oct. 2008. Environment News Service (ENS). 07 July 2009 <http://www.nbcchicago.com/news/green/Solar_Powers_Staples_Center_Events__Green_Cuisine_Factory.html>.

Brown, Bob. "Celtics injuries? Kobe Bryant’s shooting? Nah, tech’s the real story at NBA Finals | NetworkWorld.com Community." NetworkWorld.com - Network World. 06 June 2008. NetworkWorld. 07 July 2009 <http://www.networkworld.com/community/node/28521>.