Logistics Industry: Energy Cost Reduction and Tax Savings

The UPS television commercials accompanied by a fun logistics jingle have engagingly presented the core processes related to package and product delivery. America's leading logistics companies are the arteries of commerce that maintain the constant flow of goods from production to end uses.

Logistics companies consume tremendous amounts of fuel for air and truck fleets and for their cavernous warehouse properties. New technologies are enabling logistics companies to change fuel sources and greatly reduce operating costs. Logistic companies that want to maintain market share with America’s largest companies need to regularly reduce energy use.

The EPAct Section 179D Tax Opportunities

Pursuant to Energy Policy Act (EPAct) Section 179D, warehouse and distribution center building owners or tenants making qualifying energy-reducing investments in their new or existing locations can obtain immediate tax deductions of up to $1.80 per square foot.

If the building project doesn't qualify for the maximum EPAct Section 179D $1.80 per square foot immediate tax deduction, there are tax deductions of up to $0.60 per square foot for each of the three major building subsystems: lighting, HVAC, and the building envelope. The building envelope is every item on the building’s exterior perimeter that touches the outside world including roof, walls, insulation, doors, windows and foundation.

The table below illustrates the potential EPAct tax deductions available for some of America’s largest logistics companies with energy efficient building improvements.

Largest Logistics Companies

Air Fleets

New fuel efficient aircraft use substantially less fuel than current aircraft. The Boeing 787 Dreamliner uses 20% less fuel and produces 20% less emissions than the average similar sized aircraft.1

In 2011 FedEx achieved a 13.8% reduction in aircraft emissions. As of May 2012 Fed Ex operates 660 aircraft and is committed to purchase 28 more throughout 2012-2013. The company recently announced their initiatives in efficiency which includes reducing flights and frequencies.

Over the next few years FedEx will purchase 19 Boeing 767 planes to replace their current MD10s and A31-200s. They will also purchase 27 Boeing 767-300 freight planes. With 30% more fuel efficiency than their current planes, FedEx can expect a 20% reduction in operating costs.2

FedEx also delayed the delivery of its 777 freight aircraft. This is expected to result in lower overall costs and investment, a better utilization of their MD-11 fleet for international flights, and significant long term fleet efficiency.

In addition to fuel efficiency in aircraft, the aircraft hangers have been installing energy efficient lighting to reduce operating costs.3

In 2011, FedEx installed a green roof at its 175,000 square foot O’Hare International Airport cargo facility. They also have a 145,000 square foot hangar at Memphis International Airport and a 114,000 square foot hangar at Chattanooga Airport.

UPS operates a fleet of over 560 aircraft. The company’s Worldport aircraft hub, at 5.2 million square feet, is located in the Louisville International airport. UPS also operates air hubs in CT, CA, PA, and IL as well as a 535,000 square foot sorting facility at Memphis International Airport.4

UPS’s 3.7 million square foot logistics campus is also located in Louisville, KY. Logistics facilities, especially near major airports as such, have very large square footage and are often able to obtain large EPAct deductions.5

Truck Fleets

Truck fuel cost has also drastically improved from a combination of efficiency, new fuel sources including Compressed Natural Gas (CNG), and new technologies such as idling reduction.

Idling reduction involves the installation of a technology or device that allows main engines to refrain from unnecessary long periods of idling using an alternative technology. These devices can be installed on buses, trucks, cars, marine vessels, and equipment. This idling reduction technology is also designed to provide heat, AC, and electricity while in parked or idling, which would normally require the operation of the main engine.6

Compressed natural gas, or liquefied natural gas (LNG), and other alternative fuels are becoming more widely used in the commercial aspect. Companies like UPS, FedEx, PepsiCo, Frito-Lay, AT&T, and Waste Management have been integrating natural gas vehicles into their fleets. UPS operates 1,100 natural gas trucks, Frito-Lay added 67 trucks fueled by CNG to their fleet, and FedEx operates 58 trucks fueled by natural gas.

UPS has begun using prototype vans that have achieved a 40% increase in fuel efficiency compared to their traditional vans. The company expects to use these vans on a wider scale and for high-mileage routes by 2013.7

FedEx has taken fuel efficient initiatives for their truck fleet. The company has increased its green fleet by 18%, including 364 hybrid-electric vehicles and 118 electric vehicles. “FedEx expects that over 35% of its U.S. pick-up and delivery fleet will be equipped with 11,000 such vehicles by the end of 2013.”2

These initiatives bring truck distribution centers closer to achieving the available EPAct tax incentives.8

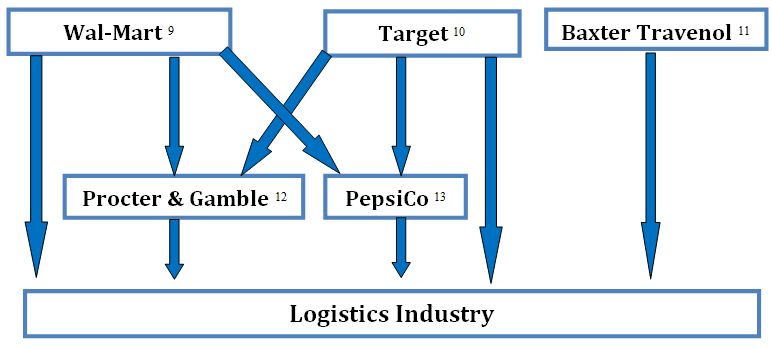

Major Purchaser Supply Chain Sustainability Programs

Many purchasers of logistics services are driving energy efficiency initiatives throughout their supply and encouraging logistics companies to reduce energy costs and emissions.

The table below presents some of the major supply chain programs impacting the logistics industry.

Conclusion

Perhaps more than any other industry, the logistics industry understands what it means to reduce fuel costs. The large logistics companies also have huge facilities where major energy cost savings and large EPAct tax savings are readily achievable.

1- Boeing 787 Dreamliner, Program Fact Sheet. Accessed at: http://www.boeing.com/commercial/787family/programfacts.html

2- Zacks.com, FedEx Seeks Sustainable Transport – Analyst Blog, NASDAQ, August 21, 2012. Accessed at: http://community.nasdaq.com/News/2012-08/fedex-seeks-sustainable-transport-analyst-blog.aspx?storyid=165792#.ULjv3Wfy8sR

3 - Kenneth Wood, Jennifer Pariante, and Andrea Albanese, Hangars Generate the Largest EPAct Opportunities, Corporate Business Taxation Monthly, March 2013, at 11.

4 - United Parcel Service, Inc. (2012). 10-K Annual Report 2012. Retrieved from NASDAQ website http://www.nasdaq.com/symbol/ups/sec-filings#.UTTwFTdvCU4

5 - Charles R. Goulding and Charles G. Goulding, The EPAct Tax Aspects of the Aerotropolis, April 2011, available from: http://energytaxsavers.wordpress.com/article/the-epact-tax-aspects-of-the-1xedf26uc9hpj-10/

6 - U.S. Environmental Protection Agency, SmartWay Technology Program, Verified Idling Reduction Technologies. Accessed at http://www.epa.gov/smartway/technology/idling.htm

7 - Environmental Leader, UPS Introduces 40% More Fuel-Efficient Vans, June 22, 2012. Accessed at: http://www.environmentalleader.com/2012/06/22/ups-composite-body-vans-40-more-fuel-efficient/

8 - Charles Goulding, Jacob Goldman, and Joseph Most, Energy Tax Aspects of Truck Distribution Centers, Corporate Business Taxation Monthly, September 2010, at 11.

9 - Charles Goulding, Jacob Goldman, and Christopher Winslow, The EPAct and Alternative Energy Tax Aspects of Walmart’s Supplier Sustainability Program, Corporate Business Taxation Monthly, June 2011, at 13.

10 - Charles R. Goulding, Andressa Bonafe, and Raymond Kumar, The Tax Aspects of Target’s Corporate Responsibility Program, To be published in Corporate Business Taxation Monthly.

11 - Charles R. Goulding, Jennifer Pariante, and Charles G. Goulding, The Tax Aspects of the Baxter International Medical Device Sustainability Supply Chain, Corporate Business Taxation Monthly, November 2012.

12 - Charles R. Goulding, Charles G, Goulding, and Andressa Bonafe, The Tax Aspects of the Procter & Gamble Sustainability Program, To be published in Corporate Business Taxation Monthly.

13 - Charles R. Goulding, Charles G. Goulding, and Jennifer Pariante, The Tax Aspects of the PepsiCo Sustainability Supply Chain, Corporate Business Taxation Monthly, November 2012.