The Tax Aspects of the PepsiCo Sustainability Supply Chain

Like Walmart Stores, Inc.1 within retail and Baxter International2 within medical products, Pepsico (Pepsi) takes an active role3 in managing the sustainability of its food and beverage facilities as well as its supply chain. Pepsi's particular approach has involved a mixture of supplier guidelines, energy-efficiency upgrades, and transparent engagement with the international community on the measurement and verification of its global impact. This article describes the accompanying tax aspects of Pepsi's sustainability initiatives.

EPAct Section 179D

Under Code Sec. 179D, as enacted by the Energy Policy Act of 2005 (EPAct), building owners who make qualifying energy-reducing investments can obtain immediate tax deductions of up to $1.80 per square foot.

If the building project doesn’t qualify for the maximum of $1.80 per square foot immediate tax deduction, there are tax deductions of up to $0.60 per square foot for each of the three major building subsystems: Lighting, HVAC and the Building Envelope. The building envelope covers every part of the building’s exterior perimeter that touches the outside world including roof, walls, insulation, doors, windows and foundation.

Manufacturing Facility Reaches “Near Net Zero”

LEED buildings are particularly well-positioned for tax savings4. Frito-Lay, a division of PepsiCo, affirmed that their LEED Gold certified 28-year-old, 283 acre, 160,000 square foot manufacturing plant in Casa Grande, Arizona has reached “near net zero”. When a facility reaches near net zero, it can run primarily on renewable energy sources and recycled water without creating landfill waste. Case Grande achieves net-zero largely in three key areas of energy usage: electricity, heat and water usage.

For electricity, five distinct solar power systems generate five megawatts of power, accounting for half the plant's electric needs. To reduce the plant’s need for heat, a 60,000 pound per hour biomass boiler burns wood chips from old pallets and agricultural waste from surrounding communities. It produces all the steam the plant needs while reducing natural gas usage by more than 80%. Also used and installed in the plant are high-efficiency oven burners, high-efficiency boiler controls, and waste heat recovery systems. By revamping the corn cooking process, 40% of the water used for one batch of corn tortillas gets reused for the next batch. Already heated, the reused water saves tremendous amounts of energy for Casa Grande.

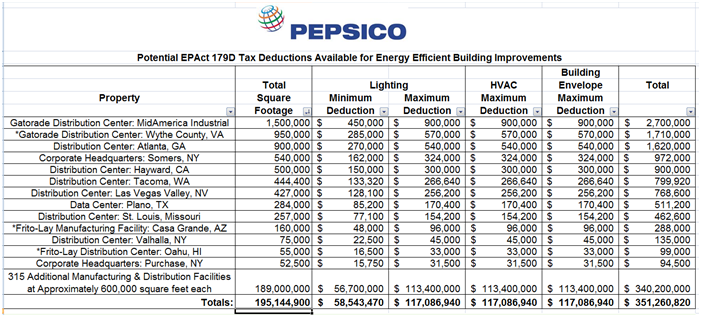

Case Grande optimizes its alternative energy usage through highly efficient lighting and HVAC systems. These systems position Case Grande for large EPAct tax deductions. The table below summarizes the opportunity for a number of Pepsi facilities, including Casa Grande

Potential EPAct 179D Tax Deductions Available for Energy Efficient Building Improvements

Pepsi Focuses on Supply Chain

Pepsi divides its efforts in supplier sustainability into four categories:

- Supplier Corporate Social Responsibility

- Sustainable Packaging

- Environmental Supplier Outreach

- Sustainable Agriculture

Over 200 of Pepsi's largest suppliers participate in its sustainability program, accounting for almost $10 billion in annual purchases. With respect to environmental outreach, a particular focus has been placed on energy efficiency. Refrigeration equipment accounts for the vast majority of Pepsi's supply chain energy use, so Pepsi has paid special attention to this type of equipment. From 2007 to 2011, one hundred Pepsi supplier facilities realized an energy reduction of 7% on average. Those kinds of improvements, like those in Pepsi's own facilities, frequently qualify facilities for tax deductions.

Innovative Supply Chain Management

Sedex is a non-profit organization which collects supply chain data from global firms in a host of sectors. The organization's two goals are to streamline supplier compliance challenges with multiple global clients, and to drive ethical improvements in those global supply chains. By joining this online, collaborative platform, PepsiCo is able to benchmark and cross-pollinate ideas with other global firms. Pepsi has also fostered relationships with organizations including ENERGY STAR, Climate Leaders, the Forest Stewardship Council, Refrigerants Naturally, the Rainforest Alliance and the Carbon Disclosure Project Supply Chain Program.

Leveraging the Entire Pepsi Sustainable Supply Chain

As a second-tier supplier, Pepsi's supply chain includes lower-tier organizations as well as first-tier food retailers, restaurants chains and beverage distributors. The large Pepsi and combined supplier sustainable supply chains can greatly assist retailers like Walmart meet their own sustainable supply chain goals.

By also integrating closely with the international community, Pepsi is able to closely monitor its impact on two issues of global significance: water usage and carbon dioxide emissions. The measures Pepsi enacts in both areas will have meaningful impacts on their facility energy efficiency. Pepsi's Performance with Purpose global operational model, therefore, has natural alignment with Federal tax incentives. As companies like Pepsi drive sustainability improvements up and down the supply chain, they should remain mindful of the incentives available to them for their efforts.

1 - Charles R. Goulding, Jacob Goldman, and Christopher Winslow, The EPAct and Alternative Energy Tax Aspects of Walmart's Supplier Sustainability Program Corp. Bus. Tax'n Monthly, June 2011

2 - Charles R. Goulding, Jennifer Pariante, and Charles G. Goulding, The Tax Aspects of the Baxter International Medical Device Sustainability Supply Chain, Corp. Bus. Tax'n Monthly, TBD

3 - Jill D'Aquila, Integrating Sustainability into the Reporting Process and Elsewhere, The CPA Journal, April 2012

4 - Charles R. Goulding, Jacob Goldman, and Daniel Audette, Advanced LEED Building Energy Tax Planning Corp. Bus. Tax'n Monthly, December 2011