The Tax Aspects of the Baxter International Medical Device Sustainability Supply Chain

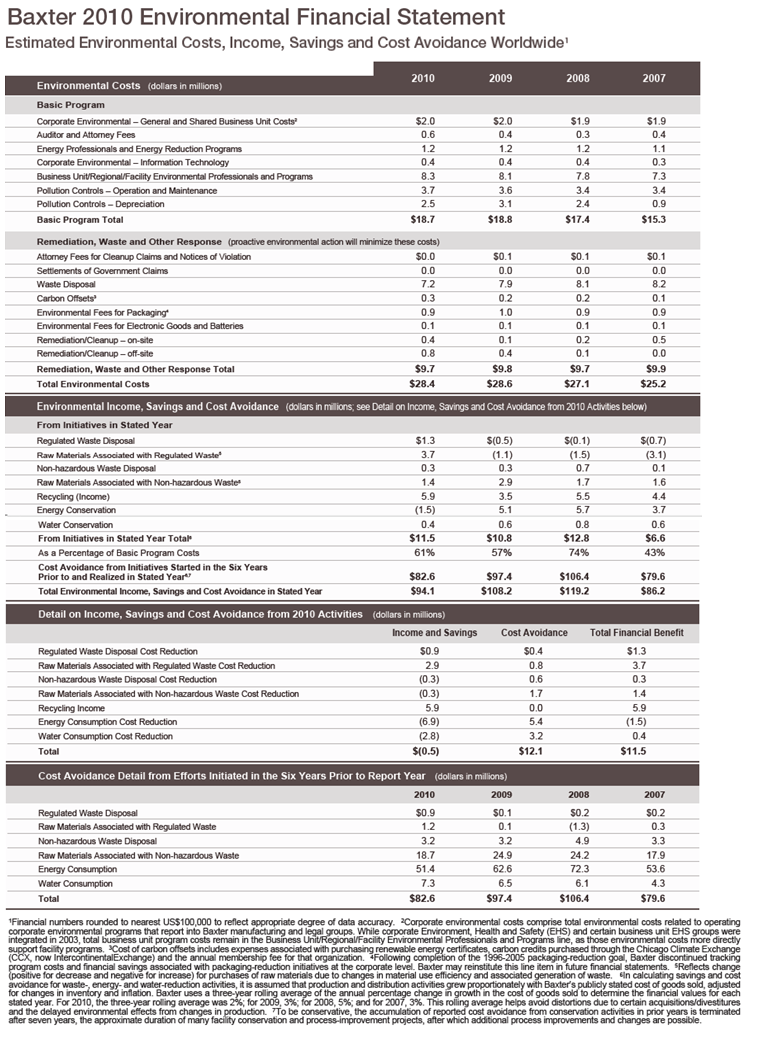

Baxter International (Baxter), the global medical device company, is one of the few companies that quantifies current and long-term economic fast return from environmental initiatives and provides an annual Environmental Financial Statement which is presented as Exhibit 1. The April 2012 issue of the CPA Journal has a comprehensive accounting reporting cover story on "Sustainability Reporting: Integrating Environmental, Social and Economic Performance" that includes a discussion of the Baxter program.

This article is designed to describe the accompanying tax aspects of the type of Sustainability Supply Chain environmental program utilized by Baxter.

EPAct Section 179D

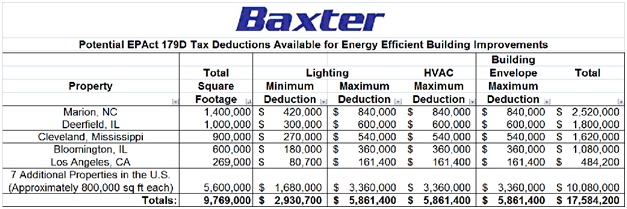

Under Code Sec. 179D, as enacted by the Energy Policy Act of 2005 (EPAct), building owners who make qualifying energy-reducing investments can obtain immediate tax deductions of up to $1.80 per square foot.If the building project doesn’t qualify for the maximum of $1.80 per square foot immediate tax deduction, there are tax deductions of up to $0.60 per square foot for each of the three major building subsystems: Lighting, HVAC and the Building Envelope. The building envelope covers every part of the building’s exterior perimeter that touches the outside world including roof, walls, insulation, doors, windows and foundation.

The Baxter Environmental Financial Statement

The complete 2010 Baxter Environmental Financial Statement is presented in Exhibit 1. The statement presents the detail for both environmental remediation, energy cost reduction measures and other initiatives for both the current year and six years prior to a report year.Potential EPAct Benefits for Baxter

Baxter's potential tax benefits from energy efficiency measures are presented below:

Typical Medical Device Company Energy Efficiency Measures

LightingAt the plant land warehouse level most medical device companies are upgrading prior generation T-12 and metal halide lighting to more energy efficient fluorescent, or LED lighting. For offices and laboratories many medical device companies are now upgrading to very low wattage LED lighting.

HVAC

IRS has just issued a notice making it easier to qualify for HVAC EPAct tax deductions by achieving a 15% overall energy cost reduction down from the previous law's 16 2/3 energy reduction standard.

For non air conditioned plant and warehouse spaces, many medical device companies are upgrading to natural gas heaters.

For their air conditioned spaces, medical device companies often use a variety of highly energy efficient equipment including chillers , geothermal , thermal storage , energy recovery ventilation and chilled beam.

Baxter Supply Chain Position

A large portion of Baxter’s product sales are to hospitals, therefore, Baxter itself is a Tier 1 supplier. Hospitals are also endeavoring to reduce their energy costs and utilizing EPAct where applicable . Tier 2 and Tier 3 property owners supplying Baxter would include component supplier companies and packaging companies. Baxter can use its own reporting data to identify energy savings projects eligible for tax savings for itself and for its lower tier suppliers. By reducing its own energy costs and encouraging its own suppliers to reduce their energy costs, the entire Baxter Supply Chain can support national health care cost reduction. Hopefully more medical device companies will follow Baxter's lead.

Exhibit 1

References

Charles R. Goulding, Spencer Marr, and Taylor Goulding, Tax Incentives for Combined Heat and Power (CHP), Corp. Bus. Tax'n Monthly, November 2011

Charles R. Goulding, Jacob Goldman, and Joseph Most, The Energy Tax Aspects of Chillers, Corp. Bus. Tax'n Monthly, October 2010

Charles R. Goulding, Joseph Most, and Spencer Marr, The Energy Tax Aspects of Geothermal Heat Pumps, Corp. Bus. Tax'n Monthly, December 2010

Charles R. Goulding, Jacob Goldman, and Taylor Goulding, The Tax Aspects of Thermal Storage and Time-of-Day Pricing, Corp. Bus. Tax'n Monthly, November 2009

Charles R. Goulding, Robert Goulding, and Raymond Kumar, The Energy Tax Aspects of Hospitals, Corp. Bus. Tax'n Monthly, November 2009