How EPAct Building Tax Incentives Support Retrofits

Now completing their seventh year, EPAct deductions are used increasingly by retrofitters in the commercial building sector and by designers of government building energy efficiency measures. This article explains why EPAct tax benefits are steadily becoming more popular and where most of the tax incentives are utilized.

Section 179D Tax Definitions

Pursuant to Energy Policy Act (EPAct) Section 179D, buildings making qualifying energy-reducing investments in their new or existing locations can obtain immediate tax deductions of up to $1.80 per square foot.

If the building project doesn't qualify for the maximum $1.80 per square foot immediate tax deduction, there are tax deductions of up to $0.60 per square foot for each of the three major building subsystems: lighting, HVAC (heating, ventilating, and air conditioning), and the building envelope. The building envelope is every item on the building’s exterior perimeter that touches the outside world including roof, walls, insulation, doors, windows and foundation.

The Dollar Opportunity

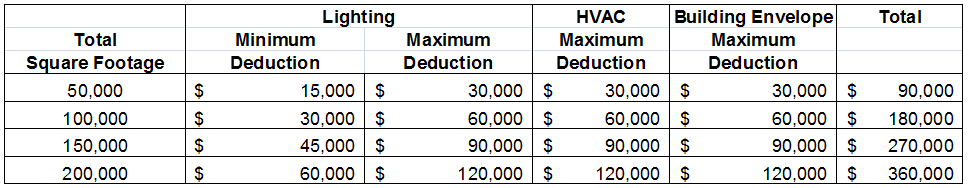

The following chart illustrates the magnitude of tax benefits available at different square footage breakpoints:

Commercial Buildings

In the commercial sector, EPAct is now being utilized by virtually all major building categories including warehouses, industrial, retail, hotels, car dealers and restaurant chains. With a tax incentive based on square footage, the largest beneficiaries are large buildings and/or property owners with multiple buildings.

In the commercial sector, the building categories that most frequently qualify for the full $1.80 incentives are warehouses1, industrial buildings2 and hotels3. In the past year LED lighting retrofits have become a very popular category4.

Government Buildings: Talking the Talk AND Walking the Walk

It may be surprising to know that as many, if not more, government buildings have achieved EPAct 179D deductions as compared to commercial buildings. For government projects, the incentive goes to the design party or parties responsible for the energy-efficient design.

Buildings at all levels of government are eligible for designer tax incentives including federal, state, and local. Frequent qualifying projects include:

•Federal- all branches of the U.S. military, all federal departments including the VA

•State- state universities (most common); courthouses, state prisons.

•Local- k-12 public schools (most common); city halls, police departments, & public libraries.

One of the most common projects impacting all the government agencies described above are parking garages. EPAct eligible government garages include: city garages, airport garages, state university garages, community college garages, VA hospital garages, state hospitals, sports stadiums, and convention centers.

Catching Up On Missed Deductions

In January 2011, IRS Released Rev. Proc. 2011-14, which enables all property owners to catch up on missed EPAct deductions. Conveniently, the deductions can be reported on the current-year tax return without having to amend returns from previous years. The retroactive filing is accomplished by filing tax Form 3115 with the building owner’s current tax return. This change can be used proactively as a tax planning tool.

Building owners who missed one or more prior tax deductions can combine the missed project(s) with a new project and secure a much larger combined tax deduction. For example, presume a warehouse owner installed energy efficient lighting in a 200,000 square foot warehouse for $100,000 in 2006 but missed the EPAct tax deduction. Now presume that, in 2012, this same owner has a new project involving natural gas heaters and some roof improvements for $260,000. Using Rev. Proc. 2011-14, this warehouse owner may be eligible to deduct the entire $360,000 in 2012 ($100,000 prior project plus $260,000 current project).

Large Increase in EPAct HVAC and Building Envelope Projects

From 2008 to the present, EPAct 179D utilization for HVAC and envelope has skyrocketed. Particularly for HVAC, certain technologies have proven to reliably beat the new standards, which have provided an incentive to plan them into many more projects. These technologies include:

1.Geothermal (Ground Source Heat Pumps)

2.Thermal Storage

3.High Efficiency VRF units in Rental Apartments/Dorms/Hotels

4.Centralized HVAC in Rental Apartments/Dorms/Hotels

5.Energy Recovery Ventilation

6.Demand Control Ventilation

7.Chillers in buildings < 150,000 sq ft

8.Direct fired heaters in no AC Industrial Spaces

9.VAV (variable air volume devices) in buildings <75,000 sq ft

10.Chilled Beam

11.Magnetic Bearing Chillers

12.Gas fired chillers combined with electric chillers to peak shave

13.Coolorado Air Conditioning Units

The EPAct 179D writers provided the foundation for useful incentives in HVAC and envelope. Thoughtful tweaks and clarifications have evolved the law into a much more useful incentive.

Conclusion

EPAct tax incentives have become an important element in retrofit projects. Those lighting, HVAC and building envelope retrofitters who know how to incorporate the incentives into their proposals and designs will reap more projects.

1 - Charles R. Goulding & Charles G. Goulding. Warehouses Cut Energy Bills and Taxes. Building Operating Management Magazine, July 2012.

2 - Charles R. Goulding, Jacob Goldman, & Cassandra Gengler. Manufacturing Facilities Drive Large EPAct Tax Deductions. Corporate Business Taxation Monthly, March 2011.

3 - Charles R. Goulding, Andrea Albanese, & Jacob Goldman. New HVAC Hotel and Apartment Technology Obtains Large EPAct Tax Incentives. Corporate Business Taxation Monthly, August 2012.

4 - Charles R. Goulding, Raymond Kumar, & Jennifer Pariante. LED Lighting Can Play A Key Role in Securing EPAct Tax Benefits. IMARK Now, February 2012.